Page 1153 - How to Make Money in Stocks Trilogy

P. 1153

138 HOW TO MAKE MONEY IN STOCKS—GETTING STARTED

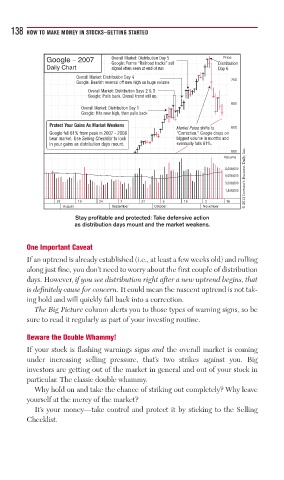

Google – 2007 Overall Market: Distribution Day 5 Price

Google: Forms “Railroad tracks” sell Distribution

Daily Chart signal often seen at end of run Day 6

Overall Market: Distribution Day 4

Google: Bearish reversal off new high on huge volume 700

Overall Market: Distribution Days 2 & 3

Google: Pulls back. Overall trend still up.

650

Overall Market: Distribution Day 1

Google: Hits new high, then pulls back

Protect Your Gains As Market Weakens Market Pulse shifts to 600

Google fell 61% from peak in 2007 - 2008 “Correction.” Google drops on

bear market. Use Selling Checklist to lock biggest volume in months and

in your gains as distribution days mount. eventually falls 61%.

© 2013 Investor’s Business Daily, Inc.

550

Volume

8,000,000

5,000,000

3,000,000

1,800,000

27 10 24 7 21 5 19 2 16

August September October November

Stay profitable and protected: Take defensive action

as distribution days mount and the market weakens.

One Important Caveat

If an uptrend is already established (i.e., at least a few weeks old) and rolling

along just fine, you don’t need to worry about the first couple of distribution

days. However, if you see distribution right after a new uptrend begins, that

is definitely cause for concern. It could mean the nascent uptrend is not tak-

ing hold and will quickly fall back into a correction.

The Big Picture column alerts you to those types of warning signs, so be

sure to read it regularly as part of your investing routine.

Beware the Double Whammy!

If your stock is flashing warnings signs and the overall market is coming

under increasing selling pressure, that’s two strikes against you. Big

investors are getting out of the market in general and out of your stock in

particular. The classic double whammy.

Why hold on and take the chance of striking out completely? Why leave

yourself at the mercy of the market?

It’s your money—take control and protect it by sticking to the Selling

Checklist.