Page 208 - How to Make Money in Stocks Trilogy

P. 208

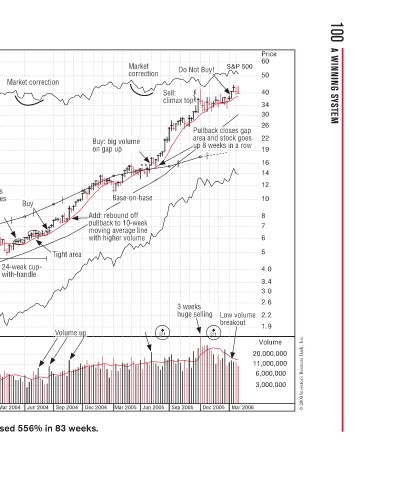

100 A WINNING SYSTEM

Price 60 50 40 34 30 26 22 19 16 14 12 10 8 7 6 5 4.0 3.4 3.0 2.6 2.2 1.9 Volume 20,000,000 11,000,000 6,000,000 3,000,000 © 2009 Investor’s Business Daily, Inc.

S&P 500 ck closes gap s s s s and stock goes a and stock goes k c up 8 weeks in a row p 8 weeks in a row a i Low volume Low volume v w breakout k e Mar 2006

Do Not Buy! Do Not Buy! y y N x top o ack c Pullback c k k u ea an a area a area e w up 8 p p up p s 3 weeks e huge selling g huge selling huge selling g g e 2/1 Dec 2005

D

Sell: Sell: e climax top i 3 h Sep 2005

2/1 Jun 2005

o

Market k M correction correction r c e m e e e eonbase e-on-base b o o k e - e g m l

Buy: big volume l o big y on gap up on gap up g Base-o se-o Base s B d: rebound off bound off n d: rebo pullback to 10-week b moving average line a i with higher volume with higher volume h Mar 2005

Add:

dd:

Add

o

d

B

B

pu

pu

pu

m

A

w

p Dec 2004

Tight area Tight area r Volume up u Sep 2004

Market correction e Buy B 24-week cup- k cup eek k 24 with-handle n Jun 2004 Mar 2004

n o gh T

Note: tiny spreads for 4 weeks e n and then 2 weeks (sound bases and then 2 weeks (sound bases a n need a few weeks with small l w e ) price variation) ) r Dec 2003 Sep 2003 Southwestern Energy increased 556% in 83 weeks.

ck in g ki B 2 22 4 e So you understand e p p Jun 2003 Mar 2003 Dec 2002

base patterns like

Southwestern Energy–2004 Weekly Chart Now you’ve seen several base-on-base patterns like n on Now you ve seen several base r s this one. Compare it to IBM in 1927 on page 19, 9 m Minneapolis Honeywell in 1934 on page 22, Brunswi i 1934 o ll i l H H li 1958 on page 31, National Airlines in

tt

Price = 20*eps 2.50 2.25 2.00 1.80 1.60 1.50 1.40 1.30 1.20 1.10 1.00 0.90 w 0.80 0.75 s 0.70 Min 0.65 5 0.60 0.55 m 0.50 a 0.45 0.40 0.35 0.30 0.25 0.23 0.20 0.18 0.16 0.15 0.14 0.13 0.12 0.