Page 308 - How to Make Money in Stocks Trilogy

P. 308

S = Supply and Demand: Big Volume Demand at Key Points 185

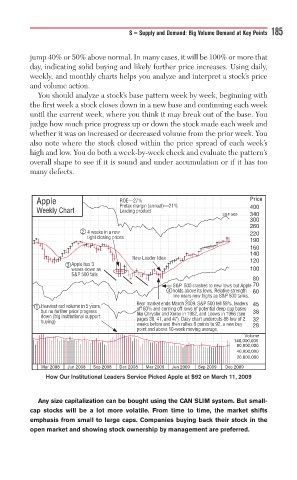

jump 40% or 50% above normal. In many cases, it will be 100% or more that

day, indicating solid buying and likely further price increases. Using daily,

weekly, and monthly charts helps you analyze and interpret a stock’s price

and volume action.

You should analyze a stock’s base pattern week by week, beginning with

the first week a stock closes down in a new base and continuing each week

until the current week, where you think it may break out of the base. You

judge how much price progress up or down the stock made each week and

whether it was on increased or decreased volume from the prior week. You

also note where the stock closed within the price spread of each week’s

high and low. You do both a week-by-week check and evaluate the pattern’s

overall shape to see if it is sound and under accumulation or if it has too

many defects.

Apple ROE—27E—2 % Price

Prettax mmx argingg (a( nnun al))a —21— %%% 400

Weekly Chart Leaading prding odud ct

S&P 500 340

300

260

2 2 4weekse in a roww 220

tightg closc ing priig p ces

190

160

140

New Leader Ideaer IdL 120

N

3 A Apple has 3

w w wavesavess ddoownwnw aaass 100

S S&P 5005 f falls

80

S S&P&P& 500 5000 ccrrasashhesese ttoo nneewww lolowwss bbutut AAppppllee 70

4 4 4 h holoo ddss aaabboveovee ititss loloowwss... RRelaelaatitiveveve sstrtreengtngthh 60

linnne neaars new highw highiw highss asas SSSSS&P&P 500 t5 anks.

B Beaeaar mr maaarrkekett eendndndnndssssss MaMaaMaMarrrrcccch 2009h 200992h20h20 .. SS&P&PP 500 5000 fellfelll 58%,58%, lealeaddeerrrss 45

H H

Heav

1 1 1 1 Heaviiesest rtreeddd volvololummuuuuumeee in 5in 5n5nin 5 yeayeay aaarrrssssss, off 60%% aandnd comingm off loows ofo pottentiala deee p cup basess

b b b but nut noo ffuurrthththttheeeeeer prir prirrr ce ce prprroogrgresese ss 38

doownwn (b(big innigig stitutiu onala suppp orrt l l l liiikeekekeeke CCChhhhhrrysleysley r r aand Xnd Xeerroxoxo in 1962, in 19622xx a and Lnd Ld oeoeewwss in 1966 in 1966 (se(seeeee

b buuyyy ginging))) p paagggeses 38388,, 41,41,1 aand 47nd 47d 47).). DDaaiiilyly cchhhaarrt undt undu eerrrccututsss 8686 loloww ofof 2222 32

weekse befoe ree and thd eenralllies 6 pp6 ointn s too 92, ,, a new buyy 28

point andd aboveo 10-w avev ragge.

10-week mmk ovingi

Volume

140,000,000

80,000,000

40,000,000

20,000,000

Mar 2008 Jun 2008 Sep 2008 Dec 2008 Mar 2009 Jun 2009 Sep 2009 Dec 2009

How Our Institutional Leaders Service Picked Apple at $92 on March 11, 2009

Any size capitalization can be bought using the CAN SLIM system. But small-

cap stocks will be a lot more volatile. From time to time, the market shifts

emphasis from small to large caps. Companies buying back their stock in the

open market and showing stock ownership by management are preferred.