Page 401 - How to Make Money in Stocks Trilogy

P. 401

276 BE SMART FROM THE START

Should You Invest for the Long Haul?

If you do decide to concentrate, should you invest for the long haul or trade

more frequently? The answer is that the holding period (long or short) is not

the main issue. What’s critical is buying the right stock—the very best

stock—at precisely the right time, then selling it whenever the market or

your various sell rules tell you it’s time to sell. The time between your buy

and your sell could be either short or long. Let your rules and the market

decide which one it is. If you do this, some of your winners will be held for

three months, some for six months, and a few for one, two, or three years or

more. Most of your losers will be held for much shorter periods, normally

between a few weeks and three months. No well-run portfolio should ever,

ever have losses carried for six months or more. Keep your portfolio clean

and in sync with the market. Remember, good gardeners always weed the

flower patch and prune weak stems.

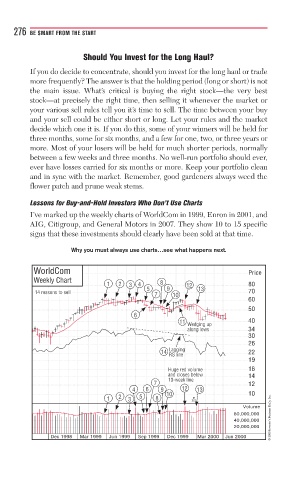

Lessons for Buy-and-Hold Investors Who Don’t Use Charts

I’ve marked up the weekly charts of WorldCom in 1999, Enron in 2001, and

AIG, Citigroup, and General Motors in 2007. They show 10 to 15 specific

signs that these investments should clearly have been sold at that time.

Why you must always use charts…see what happens next.

WorldCom Price

Weekly Chart

1 2 3 4 8 12 80

14 reasons to sellreasons to selllsons t 5 9 13 70

14

7 10

60

50

6

11 40

Wedging up dging

along g g 34

along lowslowsg low

30

26

Laggingg g

14 22

RS

RS lineli

19

Huge red volumered volumed volug e 16

Huge

and closes belowses bel w 14

10-week linekw

7 12

4 6 9 12 13 10

1 2 3 5 8 10 3/2

Volume

80,000,000

40,000,000 © 2009 Investor’s Business Daily, Inc.

20,000,000

Dec 1998 Mar 1999 Jun 1999 Sep 1999 Dec 1999 Mar 2000 Jun 2000