Page 107 - Account 10

P. 107

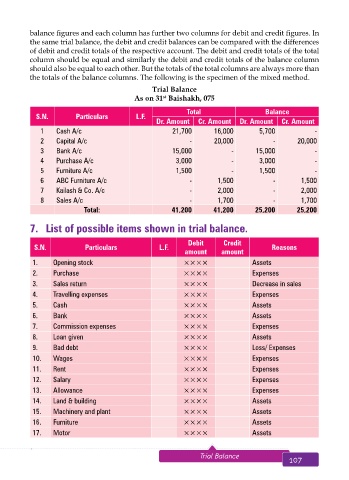

balance figures and each column has further two columns for debit and credit figures. In

the same trial balance, the debit and credit balances can be compared with the differences

of debit and credit totals of the respective account. The debit and credit totals of the total

column should be equal and similarly the debit and credit totals of the balance column

should also be equal to each other. But the totals of the total columns are always more than

the totals of the balance columns. The following is the specimen of the mixed method.

Trial Balance

As on 31 Baishakh, 075

st

Total Balance

S.N. Particulars L.F.

Dr. Amount Cr. Amount Dr. Amount Cr. Amount

1 Cash A/c 21,700 16,000 5,700 -

2 Capital A/c - 20,000 - 20,000

3 Bank A/c 15,000 - 15,000 -

4 Purchase A/c 3,000 - 3,000 -

5 Furniture A/c 1,500 - 1,500 -

6 ABC Furniture A/c - 1,500 - 1,500

7 Kailash & Co. A/c - 2,000 - 2,000

8 Sales A/c - 1,700 - 1,700

Total: 41,200 41,200 25,200 25,200

7. List of possible items shown in trial balance.

Debit Credit

S.N. Particulars L.F. Reasons

amount amount

1. Opening stock ×××× Assets

2. Purchase ×××× Expenses

3. Sales return ×××× Decrease in sales

4. Travelling expenses ×××× Expenses

5. Cash ×××× Assets

6. Bank ×××× Assets

7. Commission expenses ×××× Expenses

8. Loan given ×××× Assets

9. Bad debt ×××× Loss/ Expenses

10. Wages ×××× Expenses

11. Rent ×××× Expenses

12. Salary ×××× Expenses

13. Allowance ×××× Expenses

14. Land & building ×××× Assets

15. Machinery and plant ×××× Assets

16. Furniture ×××× Assets

17. Motor ×××× Assets

106 Aakar’s Office Practice and Accountancy - 10 Trial Balance 107