Page 265 - Account 10

P. 265

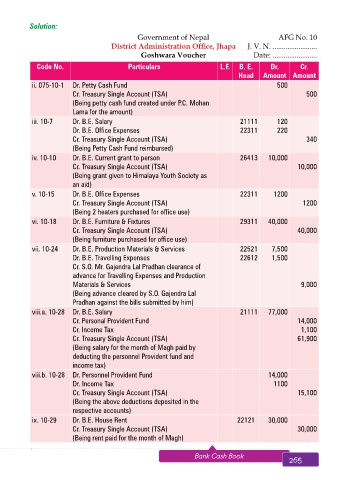

Solution:

Government of Nepal AFG No. 10

District Administration Office, Jhapa J. V. N. ........................

Goshwara Voucher Date: ........................

Code No. Particulars L.F. B. E. Dr. Cr.

Head Amount Amount

ii. 075-10-1 Dr. Petty Cash Fund 500

Cr. Treasury Single Account (TSA) 500

(Being petty cash fund created under P.C. Mohan

Lama for the amount)

iii. 10-7 Dr. B.E. Salary 21111 120

Dr. B.E. Office Expenses 22311 220

Cr. Treasury Single Account (TSA) 340

(Being Petty Cash Fund reimbursed)

iv. 10-10 Dr. B.E. Current grant to person 26413 10,000

Cr. Treasury Single Account (TSA) 10,000

(Being grant given to Himalaya Youth Society as

an aid)

v. 10-15 Dr. B.E. Office Expenses 22311 1200

Cr. Treasury Single Account (TSA) 1200

(Being 2 heaters purchased for office use)

vi. 10-18 Dr. B.E. Furniture & Fixtures 29311 40,000

Cr. Treasury Single Account (TSA) 40,000

(Being furniture purchased for office use)

vii. 10-24 Dr. B.E. Production Materials & Services 22521 7,500

Dr. B.E. Travelling Expenses 22612 1,500

Cr. S.O. Mr. Gajendra Lal Pradhan clearance of

advance for Travelling Expenses and Production

Materials & Services 9,000

(Being advance cleared by S.O. Gajendra Lal

Pradhan against the bills submitted by him)

viii.a. 10-28 Dr. B.E. Salary 21111 77,000

Cr. Personal Provident Fund 14,000

Cr. Income Tax 1,100

Cr. Treasury Single Account (TSA) 61,900

(Being salary for the month of Magh paid by

deducting the personnel Provident fund and

income tax)

viii.b. 10-28 Dr. Personnel Provident Fund 14,000

Dr. Income Tax 1100

Cr. Treasury Single Account (TSA) 15,100

(Being the above deductions deposited in the

respective accounts)

ix. 10-29 Dr. B.E. House Rent 22121 30,000

Cr. Treasury Single Account (TSA) 30,000

(Being rent paid for the month of Magh)

264 Aakar’s Office Practice and Accountancy - 10 Bank Cash Book 265