Page 268 - Account 10

P. 268

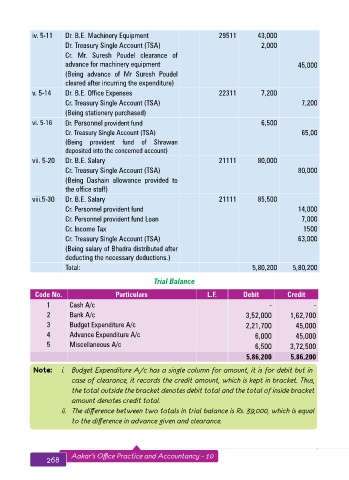

iv. 5-11 Dr. B.E. Machinery Equipment 29511 43,000

Dr. Treasury Single Account (TSA) 2,000

Cr. Mr. Suresh Poudel clearance of

advance for machinery equipment 45,000

(Being advance of Mr Suresh Poudel

cleared after incurring the expenditure)

v. 5-14 Dr. B.E. Office Expenses 22311 7,200

Cr. Treasury Single Account (TSA) 7,200

(Being stationery purchased)

vi. 5-16 Dr. Personnel provident fund 6,500

Cr. Treasury Single Account (TSA) 65,00

(Being provident fund of Shrawan

deposited into the concerned account)

vii. 5-20 Dr. B.E. Salary 21111 80,000

Cr. Treasury Single Account (TSA) 80,000

(Being Dashain allowance provided to

the office staff)

viii.5-30 Dr. B.E. Salary 21111 85,500

Cr. Personnel provident fund 14,000

Cr. Personnel provident fund Loan 7,000

Cr. Income Tax 1500

Cr. Treasury Single Account (TSA) 63,000

(Being salary of Bhadra distributed after

deducting the necessary deductions.)

Total: 5,80,200 5,80,200

Trial Balance

Code No. Particulars L.F. Debit Credit

1 Cash A/c - -

2 Bank A/c 3,52,000 1,62,700

3 Budget Expenditure A/c 2,21,700 45,000

4 Advance Expenditure A/c 6,000 45,000

5 Miscellaneous A/c 6,500 3,72,500

5,86,200 5,86,200

Note: i. Budget Expenditure A/c has a single column for amount, it is for debit but in

case of clearance, it records the credit amount, which is kept in bracket. Thus,

the total outside the bracket denotes debit total and the total of inside bracket

amount denotes credit total.

ii. The difference between two totals in trial balance is Rs. 39,000, which is equal

to the difference in advance given and clearance.

268 Aakar’s Office Practice and Accountancy - 10 Bank Cash Book 269