Page 282 - Account 10

P. 282

20, Issued a cheque no. 05380 of Rs. 50,000 against a purchase of motorcycle for office

use.

23, Rs. 20,000 was paid to Nayab Subba, Baburam Karki as advance for purchasing office

furniture.

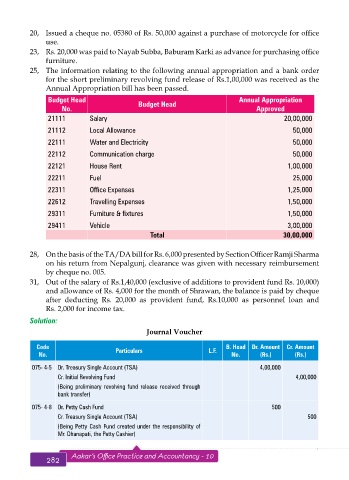

25, The information relating to the following annual appropriation and a bank order

for the short preliminary revolving fund release of Rs.1,00,000 was received as the

Annual Appropriation bill has been passed.

Budget Head Budget Head Annual Appropriation

No. Approved

21111 Salary 20,00,000

21112 Local Allowance 50,000

22111 Water and Electricity 50,000

22112 Communication charge 50,000

22121 House Rent 1,00,000

22211 Fuel 25,000

22311 Office Expenses 1,25,000

22612 Travelling Expenses 1,50,000

29311 Furniture & fixtures 1,50,000

29411 Vehicle 3,00,000

Total 30,00,000

28, On the basis of the TA/DA bill for Rs. 6,000 presented by Section Officer Ramji Sharma

on his return from Nepalgunj, clearance was given with necessary reimbursement

by cheque no. 005.

31, Out of the salary of Rs.1,40,000 (exclusive of additions to provident fund Rs. 10,000)

and allowance of Rs. 4,000 for the month of Shrawan, the balance is paid by cheque

after deducting Rs. 20,000 as provident fund, Rs.10,000 as personnel loan and

Rs. 2,000 for income tax.

Solution:

Journal Voucher

Code Particulars L.F. B. Head Dr. Amount Cr. Amount

No. No. (Rs.) (Rs.)

075- 4-5 Dr. Treasury Single Account (TSA) 4,00,000

Cr. Initial Revolving Fund 4,00,000

(Being preliminary revolving fund release received through

bank transfer)

075- 4-8 Dr. Petty Cash Fund 500

Cr. Treasury Single Account (TSA) 500

(Being Petty Cash Fund created under the responsibility of

Mr. Dhanapati, the Petty Cashier)

282 Aakar’s Office Practice and Accountancy - 10 Budget Sheet 283