Page 283 - Account 10

P. 283

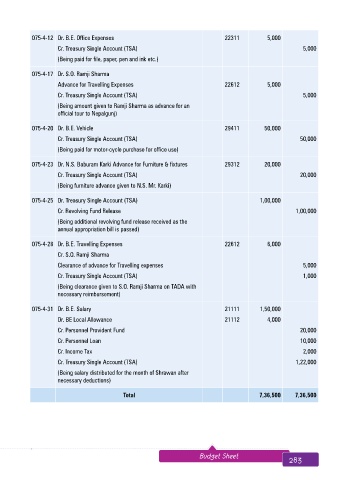

075-4-12 Dr. B.E. Office Expenses 22311 5,000

Cr. Treasury Single Account (TSA) 5,000

(Being paid for file, paper, pen and ink etc.)

075-4-17 Dr. S.O. Ramji Sharma

Advance for Travelling Expenses 22612 5,000

Cr. Treasury Single Account (TSA) 5,000

(Being amount given to Ramji Sharma as advance for an

official tour to Nepalgunj)

075-4-20 Dr. B.E. Vehicle 29411 50,000

Cr. Treasury Single Account (TSA) 50,000

(Being paid for motor-cycle purchase for office use)

075-4-23 Dr. N.S. Baburam Karki Advance for Furniture & fixtures 29312 20,000

Cr. Treasury Single Account (TSA) 20,000

(Being furniture advance given to N.S. Mr. Karki)

075-4-25 Dr. Treasury Single Account (TSA) 1,00,000

Cr. Revolving Fund Release 1,00,000

(Being additional revolving fund release received as the

annual appropriation bill is passed)

075-4-28 Dr. B.E. Travelling Expenses 22612 6,000

Cr. S.O. Ramji Sharma

Clearance of advance for Travelling expenses 5,000

Cr. Treasury Single Account (TSA) 1,000

(Being clearance given to S.O. Ramji Sharma on TADA with

necessary reimbursement)

075-4-31 Dr. B.E. Salary 21111 1,50,000

Dr. BE Local Allowance 21112 4,000

Cr. Personnel Provident Fund 20,000

Cr. Personnel Loan 10,000

Cr. Income Tax 2,000

Cr. Treasury Single Account (TSA) 1,22,000

(Being salary distributed for the month of Shrawan after

necessary deductions)

Total 7,36,500 7,36,500

282 Aakar’s Office Practice and Accountancy - 10 Budget Sheet 283