Page 292 - Account 10

P. 292

d. A cheque of Rs.70,000 was issued to Syakar Company on 2075-6-17 as an

advance for the supply of generator.

e. A cheque of Rs. 15,000 is issued against the purchases of furniture on 2075-

6-20.

f. Advance given to Syakar Company was cleared on 2075-6-25 by paying a

cheque of Rs.5,000 for the balances on receipt of generator worth Rs.75,000.

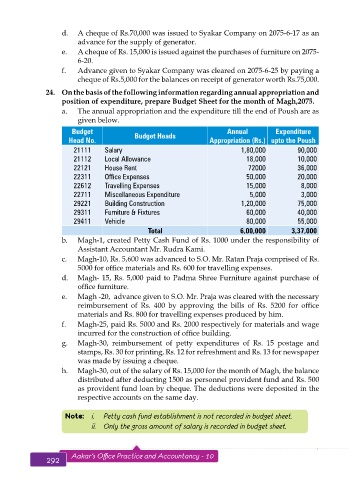

24. On the basis of the following information regarding annual appropriation and

position of expenditure, prepare Budget Sheet for the month of Magh,2075.

a. The annual appropriation and the expenditure till the end of Poush are as

given below.

Budget Budget Heads Annual Expenditure

Head No. Appropriation (Rs.) upto the Poush

21111 Salary 1,80,000 90,000

21112 Local Allowance 18,000 10,000

22121 House Rent 72000 36,000

22311 Office Expenses 50,000 20,000

22612 Travelling Expenses 15,000 8,000

22711 Miscellaneous Expenditure 5,000 3,000

29221 Building Construction 1,20,000 75,000

29311 Furniture & Fixtures 60,000 40,000

29411 Vehicle 80,000 55,000

Total 6,00,000 3,37,000

b. Magh-1, created Petty Cash Fund of Rs. 1000 under the responsibility of

Assistant Accountant Mr. Rudra Kami.

c. Magh-10, Rs. 5,600 was advanced to S.O. Mr. Ratan Praja comprised of Rs.

5000 for office materials and Rs. 600 for travelling expenses.

d. Magh- 15, Rs. 5,000 paid to Padma Shree Furniture against purchase of

office furniture.

e. Magh -20, advance given to S.O. Mr. Praja was cleared with the necessary

reimbursement of Rs. 400 by approving the bills of Rs. 5200 for office

materials and Rs. 800 for travelling expenses produced by him.

f. Magh-25, paid Rs. 5000 and Rs. 2000 respectively for materials and wage

incurred for the construction of office building.

g. Magh-30, reimbursement of petty expenditures of Rs. 15 postage and

stamps, Rs. 30 for printing, Rs. 12 for refreshment and Rs. 13 for newspaper

was made by issuing a cheque.

h. Magh-30, out of the salary of Rs. 15,000 for the month of Magh, the balance

distributed after deducting 1500 as personnel provident fund and Rs. 500

as provident fund loan by cheque. The deductions were deposited in the

respective accounts on the same day.

Note: i. Petty cash fund establishment is not recorded in budget sheet.

ii. Only the gross amount of salary is recorded in budget sheet.

Budget Sheet

Aakar’s Office Practice and Accountancy - 10

293

292

292 Aakar’s Office Practice and Accountancy - 10 Monthly Statement 293