Page 295 - Account 10

P. 295

government offices and projects. They help to compare the progress of work and utilized

budget and surplus budget for the effective evaluation, performance and progress.

v. Helps to Make Effective Decision

They provide all the necessary financial information to the concerned authority such

as budget release, expenditure, surplus, deficit, etc. which help to make effective decision.

Points to Remember

i. Provides Necessary Data ii. Controls Over Budget iii. Helps in Auditing

iv. Helps to Evaluate v. Helps to Make Effective Decision

3. Types of Monthly Statement

A. Monthly Statement of Revenue (AGF No.9)

B. Monthly Statement of Expenditure (AGF No.13)

C. Monthly Statement of Advance Clearance (AGF No.14)

D. Bank Reconciliation Statement (AFG No.15)

E. Monthly Statement of Security Deposit (AGF No 19)

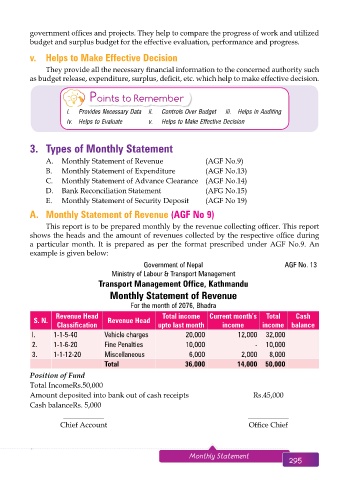

A. Monthly Statement of Revenue (AGF No 9)

This report is to be prepared monthly by the revenue collecting officer. This report

shows the heads and the amount of revenues collected by the respective office during

a particular month. It is prepared as per the format prescribed under AGF No.9. An

example is given below:

Government of Nepal AGF No. 13

Ministry of Labour & Transport Management

Transport Management Office, Kathmandu

Monthly Statement of Revenue

For the month of 2076, Bhadra

Revenue Head Total income Current month’s Total Cash

S. N. Revenue Head

Classification upto last month income income balance

l. 1-1-5-40 Vehicle charges 20,000 12,000 32,000

2. 1-1-6-20 Fine Penalties 10,000 - 10,000

3. 1-1-12-20 Miscellaneous 6,000 2,000 8,000

Total 36,000 14,000 50,000

Position of Fund

Total Income Rs.50,000

Amount deposited into bank out of cash receipts Rs.45,000

Cash balance Rs. 5,000

___________ ___________

Chief Account Office Chief

294 Aakar’s Office Practice and Accountancy - 10 Monthly Statement 295