Page 317 - Account 10

P. 317

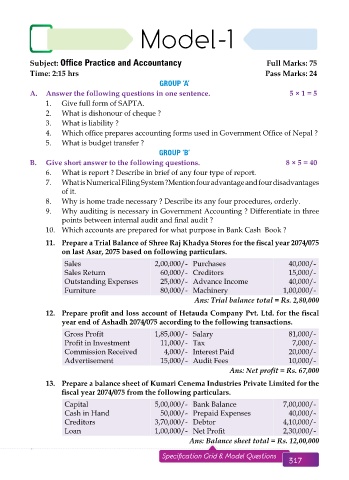

Model-1

Subject: Office Practice and Accountancy Full Marks: 75

Time: 2:15 hrs Pass Marks: 24

GROUP ‘A’

A. Answer the following questions in one sentence. 5 × 1 = 5

1. Give full form of SAPTA.

2. What is dishonour of cheque ?

3. What is liability ?

4. Which office prepares accounting forms used in Government Office of Nepal ?

5. What is budget transfer ?

GROUP ‘B’

B. Give short answer to the following questions. 8 × 5 = 40

6. What is report ? Describe in brief of any four type of report.

7. What is Numerical Filing System ?Mention four advantage and four disadvantages

of it.

8. Why is home trade necessary ? Describe its any four procedures, orderly.

9. Why auditing is necessary in Government Accounting ? Differentiate in three

points between internal audit and final audit ?

10. Which accounts are prepared for what purpose in Bank Cash Book ?

11. Prepare a Trial Balance of Shree Raj Khadya Stores for the fiscal year 2074/075

on last Asar, 2075 based on following particulars.

Sales 2,00,000/- Purchases 40,000/-

Sales Return 60,000/- Creditors 15,000/-

Outstanding Expenses 25,000/- Advance Income 40,000/-

Furniture 80,000/- Machinery 1,00,000/-

Ans: Trial balance total = Rs. 2,80,000

12. Prepare profit and loss account of Hetauda Company Pvt. Ltd. for the fiscal

year end of Ashadh 2074/075 according to the following transactions.

Gross Profit 1,85,000/- Salary 81,000/-

Profit in Investment 11,000/- Tax 7,000/-

Commission Received 4,000/- Interest Paid 20,000/-

Advertisement 15,000/- Audit Fees 10,000/-

Ans: Net profit = Rs. 67,000

13. Prepare a balance sheet of Kumari Cenema Industries Private Limited for the

fiscal year 2074/075 from the following particulars.

Capital 5,00,000/- Bank Balance 7,00,000/-

Cash in Hand 50,000/- Prepaid Expenses 40,000/-

Creditors 3,70,000/- Debtor 4,10,000/-

Loan 1,00,000/- Net Profit 2,30,000/-

Ans: Balance sheet total = Rs. 12,00,000

316 Aakar’s Office Practice and Accountancy - 10 Specification Grid & Model Questions 317