Page 88 - Account 10

P. 88

ii. Insurance companies do not make the compensation promptly on maturity of the

policy or for the financial losses as compared to the attitude of the insured.

iii. It leads to crimes in the society as the beneficiaries of the insurance policy may be

tempted to commit the crimes to receive the amount insured.

iv. In case of long term policies, the accumulated fund of the premium would be more

than the policy amount receivable at maturity. Moreover, compensation is not

receivable if no loss is incurred even though the premium is paid regularly.

v. It doesn’t compensate all types of loss and damage.

vi. Sometimes total amount of premium might be higher than the insured amount after

the expiry of policy period, etc.

Although insurance encourages saving, it does not provide all the facilities provided by

a bank. So, people may think to deposit their saving in a bank rather than taking an

insurance policy.

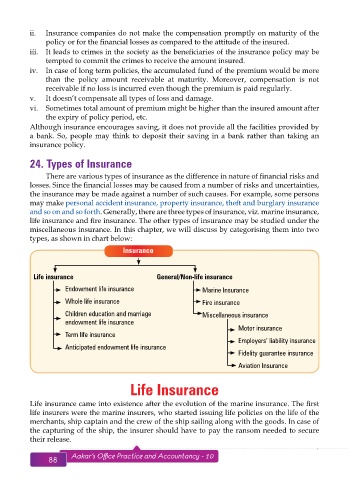

24. Types of Insurance

There are various types of insurance as the difference in nature of financial risks and

losses. Since the financial losses may be caused from a number of risks and uncertainties,

the insurance may be made against a number of such causes. For example, some persons

may make personal accident insurance, property insurance, theft and burglary insurance

and so on and so forth. Generally, there are three types of insurance, viz. marine insurance,

life insurance and fire insurance. The other types of insurance may be studied under the

miscellaneous insurance. In this chapter, we will discuss by categorising them into two

types, as shown in chart below:

Insurance

Life insurance General/Non-life insurance

Endowment life insurance Marine Insurance

Whole life insurance Fire insurance

Children education and marriage Miscellaneous insurance

endowment life insurance

Motor insurance

Term life insurance

Employers’ liability insurance

Anticipated endowment life insurance

Fidelity guarantee insurance

Aviation Insurance

Life Insurance

Life insurance came into existence after the evolution of the marine insurance. The first

life insurers were the marine insurers, who started issuing life policies on the life of the

merchants, ship captain and the crew of the ship sailing along with the goods. In case of

the capturing of the ship, the insurer should have to pay the ransom needed to secure

their release.

88 Aakar’s Office Practice and Accountancy - 10 Financial Institutions 89