Page 93 - Account 10

P. 93

c. Fidelity Guarantee Insurance

Employees or workers make mistake knowingly or unknowingly which causes loss

to the organization. Sometimes the employees may do frauds, embezzlement and theft in

the organization. So, to compensate the loss of organization, a policy is issued known as

Fidelity Guarantee Insurance.

Key Point The insurance which compensates the financial loss caused to the

organization due to embezzlement,, theft frauds or dishonesty committed

by an employee is known as fidelity guarantee insurance.

d. Aviation Insurance

The insurance, which is made to compensate the

loss incurred by aviation risks and accidents, is known

as aviation insurance. The insurance provides financial

security to the body of aircraft cargo, passengers as

well as third party. Aeroplane crash

Key Point The insurance which covers the risk of aviation and provides financial

compensation in care of loss of aircraft, cargo and death of passenger is

known as aviation insurance.

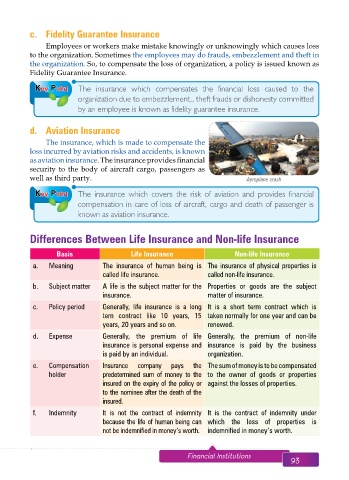

Differences Between Life Insurance and Non-life Insurance

Basis Life Insurance Non-life Insurance

a. Meaning The insurance of human being is The insurance of physical properties is

called life insurance. called non-life insurance.

b. Subject matter A life is the subject matter for the Properties or goods are the subject

insurance. matter of insurance.

c. Policy period Generally, life insurance is a long It is a short term contract which is

tern contract like 10 years, 15 taken normally for one year and can be

years, 20 years and so on. renewed.

d. Expense Generally, the premium of life Generally, the premium of non-life

insurance is personal expense and insurance is paid by the business

is paid by an individual. organization.

e. Compensation Insurance company pays the The sum of money is to be compensated

holder predetermined sum of money to the to the owner of goods or properties

insured on the expiry of the policy or against the losses of properties.

to the nominee after the death of the

insured.

f. Indemnity It is not the contract of indemnity It is the contract of indemnity under

because the life of human being can which the loss of properties is

not be indemnified in money’s worth. indemnified in money’s worth.

92 Aakar’s Office Practice and Accountancy - 10 Financial Institutions 93