Page 103 - Office Practice and Accounting 10

P. 103

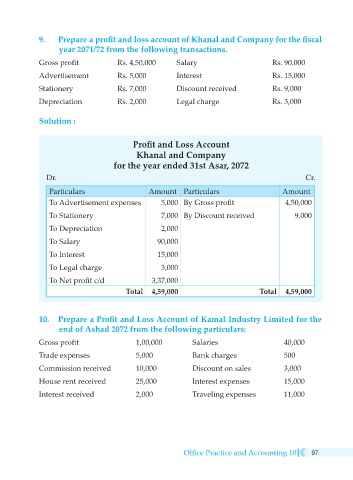

9. Prepare a profit and loss account of Khanal and Company for the fiscal

year 2071/72 from the following transactions.

Gross profit Rs. 4,50,000 Salary Rs. 90,000

Advertisement Rs. 5,000 Interest Rs. 15,000

Stationery Rs. 7,000 Discount received Rs. 9,000

Depreciation Rs. 2,000 Legal charge Rs. 3,000

Solution :

Profit and Loss Account

Khanal and Company

for the year ended 31st Asar, 2072

Dr. Cr.

Particulars Amount Particulars Amount

To Advertisement expenses 5,000 By Gross profit 4,50,000

To Stationery 7,000 By Discount received 9,000

To Depreciation 2,000

To Salary 90,000

To Interest 15,000

To Legal charge 3,000

To Net profit c/d 3,37,000

Total 4,59,000 Total 4,59,000

10. Prepare a Profit and Loss Account of Kamal Industry Limited for the

end of Ashad 2072 from the following particulars:

Gross profit 1,00,000 Salaries 40,000

Trade expenses 5,000 Bank charges 500

Commission received 10,000 Discount on sales 3,000

House rent received 25,000 Interest expenses 15,000

Interest received 2,000 Traveling expenses 11,000

Office Practice and Accounting 10 97