Page 131 - Office Practice and Accounting 10

P. 131

the history of employees and detail about salary of the government offices. This office

is functioning still today. In 1936 BS Khardar Gunwant, a government employee,

introduced 'Syaha Shrestha Pranali' an accounting system to maintain government

revenues and expenditures. The Shyaha Srestha Pranali was an advanced form of

recording the transactions which remained in practice upto fiscal year 2022/23 BS.

After the establishment of democracy in 2007 BS, the government became more

responsible to maintain books of accounts. As a result, the budget system was started

in 2008 BS. In 2016 B.S. "Procedure Rule for Government Fund Expenditure 2016" was

enacted with a view to bringing uniformity in financial administration. Then, in Baisakh

2017 BS, Bhuktani Shresta Pranali was introduced. But Bhuktani Shresta Pranali could

not last long as new accounting system was introduced as per the recommendation

of accounts committee. So, on 20th Magh, 2017 an account committee was formed

to study and make suggestions for an appropriate and scientific accounting system.

After the detailed study for 288 days, the committee presented a draft to the finance

secretary which got recognition from the Auditor General and final approval from

king Mahendra in 2018 BS. This accounting system is known as 'New Accounting

System" of Government of Nepal, which was scientific and systematic. This system

has been followed by Government of Nepal since the fiscal year 2019/20 and still is in

practice these days.

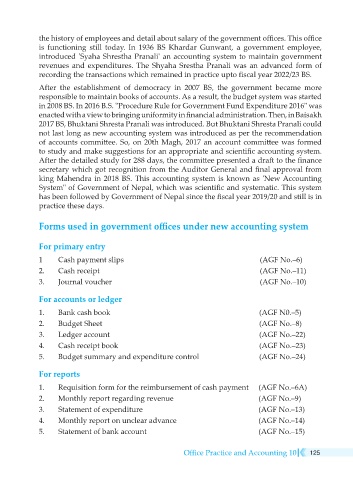

Forms used in government offices under new accounting system

For primary entry

1 Cash payment slips (AGF No.–6)

2. Cash receipt (AGF No.–11)

3. Journal voucher (AGF No.–10)

For accounts or ledger

1. Bank cash book (AGF N0.–5)

2. Budget Sheet (AGF No.–8)

3. Ledger account (AGF No.–22)

4. Cash receipt book (AGF No.–23)

5. Budget summary and expenditure control (AGF No.–24)

For reports

1. Requisition form for the reimbursement of cash payment (AGF No.–6A)

2. Monthly report regarding revenue (AGF No.–9)

3. Statement of expenditure (AGF No.–13)

4. Monthly report on unclear advance (AGF No.–14)

5. Statement of bank account (AGF No.–15)

Office Practice and Accounting 10 125