Page 309 - Office Practice and Accounting 10

P. 309

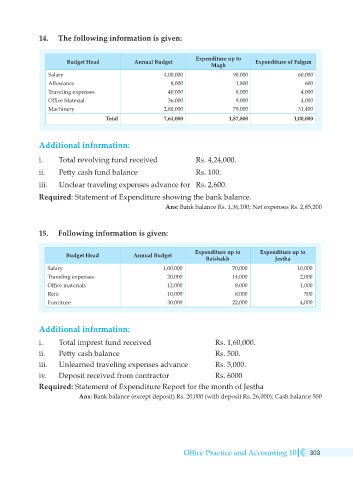

14. The following information is given:

Expenditure up to

Budget Head Annual Budget Magh Expenditure of Falgun

Salary 4,00,000 90,000 60,000

Allowance 8,000 1,800 600

Traveling expenses 40,000 8,000 4,000

Office Material 36,000 9,000 4,000

Machinery 2,80,000 79,000 31,400

Total 7,64,000 1,87,800 1,00,000

Additional information:

i. Total revolving fund received Rs. 4,24,000.

ii. Petty cash fund balance Rs. 100.

iii. Unclear traveling expenses advance for Rs. 2,600.

Required: Statement of Expenditure showing the bank balance.

Ans: Bank balance Rs. 1,36,100; Net expenses Rs. 2,85,200

15. Following information is given:

Expenditure up to Expenditure up to

Budget Head Annual Budget Baishakh Jestha

Salary 1,00,000 70,000 10,000

Traveling expenses 20,000 14,000 2,000

Office materials 12,000 8,000 1,000

Rent 10,000 8,000 500

Furniture 30,000 22,000 4,000

Additional information:

i. Total imprest fund received Rs. 1,60,000.

ii. Petty cash balance Rs. 500.

iii. Unlearned traveling expenses advance Rs. 5,000.

iv. Deposit received from contractor Rs. 6000

Required: Statement of Expenditure Report for the month of Jestha

Ans: Bank balance (except deposit) Rs. 20,000 (with deposit Rs. 26,000); Cash balance 500

Office Practice and Accounting 10 303