Page 25 - GENIUS MAGAZINE AFRICA 7TH EDITION

P. 25

24 banking system is hosted in the cloud, reducing

overheads that allowed it to undercut the other

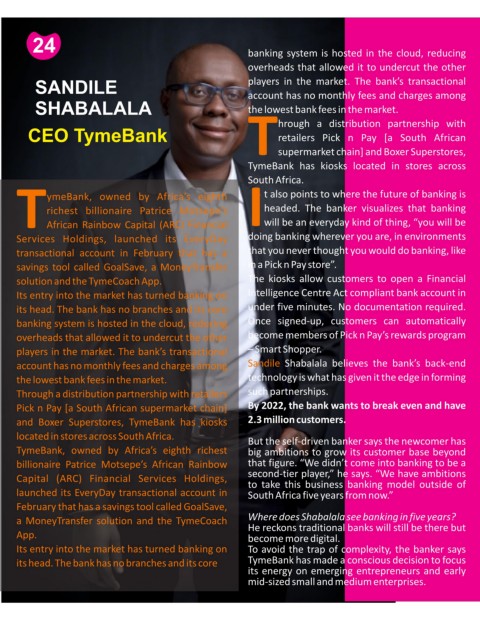

SANDILE players in the market. The bank’s transactional

account has no monthly fees and charges among

SHABALALA the lowest bank fees in the market.

T hrough a distribution partnership with

CEO TymeBank retailers Pick n Pay [a South African

supermarket chain] and Boxer Superstores,

TymeBank has kiosks located in stores across

South Africa.

T ymeBank, owned by Africa’s eighth I t also points to where the future of banking is

headed. The banker visualizes that banking

richest billionaire Patrice Motsepe’s

will be an everyday kind of thing, “you will be

African Rainbow Capital (ARC) Financial

Services Holdings, launched its EveryDay doing banking wherever you are, in environments

transactional account in February that has a that you never thought you would do banking, like

savings tool called GoalSave, a MoneyTransfer in a Pick n Pay store”.

solution and the TymeCoach App. The kiosks allow customers to open a Financial

Its entry into the market has turned banking on Intelligence Centre Act compliant bank account in

its head. The bank has no branches and its core under five minutes. No documentation required.

banking system is hosted in the cloud, reducing Once signed-up, customers can automatically

overheads that allowed it to undercut the other become members of Pick n Pay’s rewards program

players in the market. The bank’s transactional – Smart Shopper.

account has no monthly fees and charges among Sandile Shabalala believes the bank’s back-end

the lowest bank fees in the market. technology is what has given it the edge in forming

Through a distribution partnership with retailers such partnerships.

Pick n Pay [a South African supermarket chain] By 2022, the bank wants to break even and have

and Boxer Superstores, TymeBank has kiosks 2.3 million customers.

located in stores across South Africa.

But the self-driven banker says the newcomer has

TymeBank, owned by Africa’s eighth richest big ambitions to grow its customer base beyond

billionaire Patrice Motsepe’s African Rainbow that figure. “We didn’t come into banking to be a

second-tier player,” he says. “We have ambitions

Capital (ARC) Financial Services Holdings,

to take this business banking model outside of

launched its EveryDay transactional account in South Africa five years from now.”

February that has a savings tool called GoalSave,

a MoneyTransfer solution and the TymeCoach Where does Shabalala see banking in five years?

He reckons traditional banks will still be there but

App. become more digital.

Its entry into the market has turned banking on To avoid the trap of complexity, the banker says

its head. The bank has no branches and its core TymeBank has made a conscious decision to focus

its energy on emerging entrepreneurs and early

mid-sized small and medium enterprises.