Page 27 - GENIUS MAGAZINE AFRICA 7TH EDITION

P. 27

Maluleke believes the product will be a winner

because African Bank doesn’t have the “same

Basani legacy issues of the larger banks, we are not

protecting massive cost infrastructure that

Maluleke the other banks have and I think it puts us in a

very, very good position to be successful.

We’re all playing a very similar game and we

are all chasing very similar customers, the key

A overseeing the rebirth of a bank that went to deliver the best value proposition and right

to success is going to be who’s going to be able

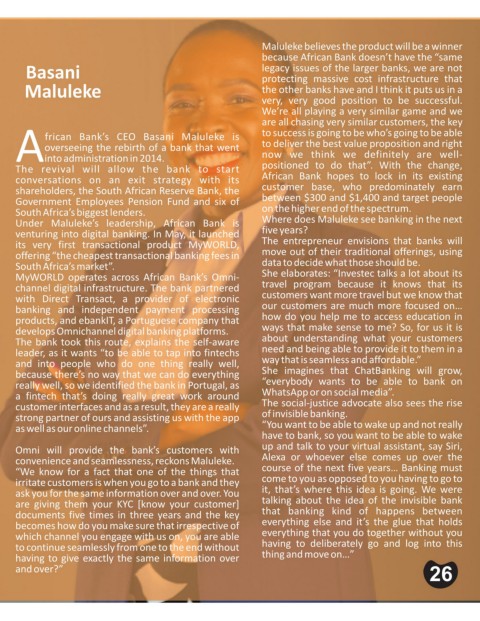

frican Bank’s CEO Basani Maluleke is

now we think we definitely are well-

into administration in 2014.

The revival will allow the bank to start positioned to do that”. With the change,

conversations on an exit strategy with its African Bank hopes to lock in its existing

shareholders, the South African Reserve Bank, the customer base, who predominately earn

Government Employees Pension Fund and six of between $300 and $1,400 and target people

South Africa’s biggest lenders. on the higher end of the spectrum.

Under Maluleke’s leadership, African Bank is Where does Maluleke see banking in the next

venturing into digital banking. In May, it launched five years?

its very first transactional product MyWORLD, The entrepreneur envisions that banks will

offering “the cheapest transactional banking fees in move out of their traditional offerings, using

South Africa’s market”. data to decide what those should be.

MyWORLD operates across African Bank’s Omni- She elaborates: “Investec talks a lot about its

channel digital infrastructure. The bank partnered travel program because it knows that its

with Direct Transact, a provider of electronic customers want more travel but we know that

banking and independent payment processing our customers are much more focused on…

products, and ebankIT, a Portuguese company that how do you help me to access education in

develops Omnichannel digital banking platforms. ways that make sense to me? So, for us it is

The bank took this route, explains the self-aware about understanding what your customers

leader, as it wants “to be able to tap into fintechs need and being able to provide it to them in a

and into people who do one thing really well, way that is seamless and affordable.”

because there’s no way that we can do everything She imagines that ChatBanking will grow,

really well, so we identified the bank in Portugal, as “everybody wants to be able to bank on

a fintech that’s doing really great work around WhatsApp or on social media”.

customer interfaces and as a result, they are a really The social-justice advocate also sees the rise

strong partner of ours and assisting us with the app of invisible banking.

as well as our online channels”. “You want to be able to wake up and not really

have to bank, so you want to be able to wake

Omni will provide the bank’s customers with up and talk to your virtual assistant, say Siri,

convenience and seamlessness, reckons Maluleke. Alexa or whoever else comes up over the

“We know for a fact that one of the things that course of the next five years… Banking must

irritate customers is when you go to a bank and they come to you as opposed to you having to go to

ask you for the same information over and over. You it, that’s where this idea is going. We were

are giving them your KYC [know your customer] talking about the idea of the invisible bank

documents five times in three years and the key that banking kind of happens between

becomes how do you make sure that irrespective of everything else and it’s the glue that holds

which channel you engage with us on, you are able everything that you do together without you

to continue seamlessly from one to the end without having to deliberately go and log into this

having to give exactly the same information over thing and move on…”

and over?”

26