Page 100 - SFG_ANNUALREPORT_12OCT_SINGLEPAGE

P. 100

NOTES TO THE FINANCIAL STATEMENTS (CONT.)

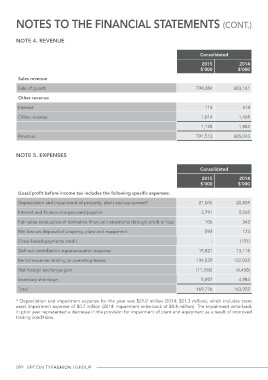

Note 4. Revenue

Consolidated 2014

$’000

2015

$’000

Sales revenue 790,384 683,161

Sale of goods

Other revenue 114 414

Interest 1,014 1,468

Other revenue 1,128 1,882

791,512 685,043

Revenue

Note 5. EXPENSES

Consolidated 2014

$’000

2015

$’000

(Loss)/profit before income tax includes the following specific expenses: 21,045 20,839

Depreciation and impairment of property, plant and equipment* 3,791 2,069

Interest and finance charges paid/payable 106 343

Fair value revaluation of derivative financial instruments through profit or loss 592 173

Net loss on disposal of property, plant and equipment - (197)

Share-based payments credit

Defined contribution superannuation expense 15,821 13,118

Rental expense relating to operating leases 134,529 127,052

Net foreign exchange gain (11,165)

Inventory shrinkage (4,458)

Total 5,057 4,983

169,776

163,922

* Depreciation and impairment expense for the year was $21.0 million (2014: $21.3 million), which includes store

asset impairment expense of $0.7 million (2014: impairment write-back of $0.4 million). The impairment write-back

in prior year represented a decrease in the provision for impairment of plant and equipment as a result of improved

trading conditions.

099