Page 103 - SFG_ANNUALREPORT_12OCT_SINGLEPAGE

P. 103

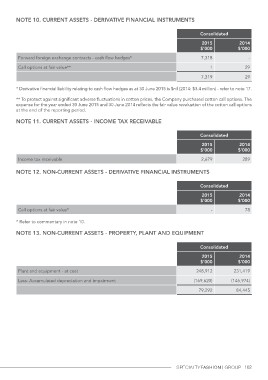

Note 10. Current assets - derivative financial instruments

Forward foreign exchange contracts - cash flow hedges* Consolidated 2014

Call options at fair value** 2015 $’000

$’000

7,318 -

1 29

7,319 29

* Derivative financial liability relating to cash flow hedges as at 30 June 2015 is $nil (2014: $3.4 million) - refer to note 17.

** To protect against significant adverse fluctuations in cotton prices, the Company purchased cotton call options. The

expense for the year ended 30 June 2015 and 30 June 2014 reflects the fair value revaluation of the cotton call options

at the end of the reporting period.

Note 11. Current assets - income tax receivable

Income tax receivable Consolidated 2014

$’000

2015

$’000 289

2,679

Note 12. Non-current assets - derivative financial instruments

Call options at fair value* Consolidated 2014

$’000

2015

$’000 78

-

* Refer to commentary in note 10.

Note 13. Non-current assets - property, plant and equipment

Consolidated

2015 2014

$’000 $’000

Plant and equipment - at cost 248,912 231,419

Less: Accumulated depreciation and impairment

(169,620) (146,974)

79,292 84,445

102