Page 10 - The Pulse Issue 6 Online

P. 10

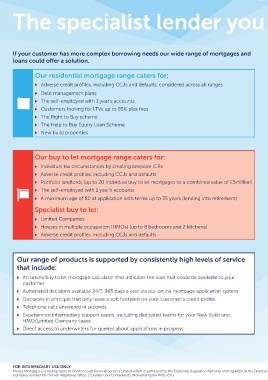

The specialist lender you can bank on

The specialist lender you can bank on

If your customer has more complex borrowing needs our wide range of mortgages and In addition to our portfolio of residential and buy to let mortgage products, we also

loans could offer a solution. offer a wide range of bridging finance and second charge loans.

Our residential mortgage range caters for: Bridging finance

Adverse credit profiles, including CCJs and defaults, considered across all ranges We’ve made many improvements to our bridging finance proposition over recent months.

Debt management plans These include the introduction of automated valuations for standard bridging products subject

to qualifying criteria, and simplified validation requirements that help to increase the speed of

The self-employed with 1 year’s accounts processing.

Customers looking for LTVs up to 85% plus fees We offer two ranges of bridging finance:

The Right to Buy scheme Regulated Bridging provides options for customers who want to use their residential

The Help to Buy Equity Loan Scheme property as security to raise funds.

New build properties Property Investor Finance provides options for customers who are experienced property

investors and want to extend/improve their portfolio.

These products could be the solution for customers who are:

Our buy to let mortgage range caters for: Purchasing a property at auction

Individual tax circumstances by creating bespoke ICRs Caught in a chain break situation

Adverse credit profiles, including CCJs and defaults Looking to expand their property portfolio

Portfolio landlords (up to 20 individual buy to let mortgages to a combined value of £5million) Refurbishing a property (light or heavy refurbishment options available)

The self-employed with 1 year’s accounts

A maximum age of 80 at application with terms up to 35 years (lending into retirement)

Second charge loans

Specialist buy to let:

Our range of buy to let and residential second charge loans could provide an alternative

Limited Companies borrowing solution for your customers.

Houses in multiple occupation (HMOs) (up to 8 bedrooms and 2 kitchens) Second charge loans can be used where a customer:

Adverse credit profiles, including CCJs and defaults

Wants to raise capital

Is looking for an alternative to a remortgage

Our range of products is supported by consistently high levels of service Can’t get a further advance from their first charge lender

that include: Wants to protect their current first charge (e.g. if they have an interest only mortgage

or a low rate)

An online buy to let mortgage calculator that indicates the loan that could be available to your

customer

Automated decisions available 24/7, 365 days a year via our online mortgage application system Visit precisemortgages.co.uk for further information on all of our criteria and products.

Decisions in principle that only leave a soft footprint on your customer’s credit profile

Telephone calls answered in seconds

Experienced intermediary support teams, including dedicated teams for your New Build and

HMO/Limited Company cases

Direct access to underwriters for queries about applications in progress Call us 0800 116 4385

Visit us precisemortgages.co.uk

Follow us

The specialist lender you can bank on

FOR INTERMEDIARY USE ONLY.

Precise Mortgages is a trading name of Charter Court Financial Services Limited which is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (Financial Services Register Firm Reference Number 494549). Registered in England and Wales recise Mortgages is a trading name of Charter Court Financial Services Limited which is authorised by the Prudential Regulation Authority and regul

P

(company number 06749498). Registered office: 2 Charter Court, Broadlands, Wolverhampton WV10 6TD.49498). Registered office: 2 Charter Court, Broadlands, Wolverhampton WV10 6TD.

(company number 067

01689 - Ingard Pulse DPS (1).indd 1 09/06/2017 09:25:07 01689 - Ingard Pulse DPS (1).indd 2 09/06/2017 09:25:08