Page 88 - AR201718

P. 88

THE SOUTH AFRICAN INSTITUTE FOR DRUG-FREE SPORT THE SOUTH AFRICAN INSTITUTE FOR DRUG-FREE SPORT

NOTES TO THE FINANCIAL STATEMENTS (continued) NOTES TO THE FINANCIAL STATEMENTS (continued)

11. DIRECTORS AND AUDIT COMMITTEE REMUNERATION 14. FINANCIAL RISK MANAGEMENT

(continued) Financial Risk Factors

2018 2017

R'000 R'000 The entity's activities expose it to a variety of financial risks: market risk (including foreign exchange risk, cash

flow, interest rate risk and liquidity risk. The overall risk management programme focuses on the unpredictabili-

Audit Commit ee ty of financial markets and seeks to minimise potentially adverse effects on the entity's financial performance.

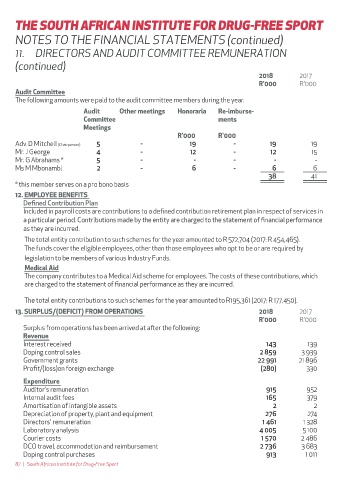

The following amounts were paid to the audit commit ee members during the year.

Audit Other meetings Honoraria Re-imburse- Foreign Exchange Risk

Commit ee ments The entity carries out a significant portion of its sales in foreign currencies. Foreign exchange risk arises when

Meetings recognised assets and liabilities are denominated in a currency that is not the entity's functional currency. The

R'000 R'000 overall risk is not deemed to be material to the entity. The sensitivity analysis in the table below shows the

Adv. D Mitchell (Chairperson) 5 - 19 - 19 19 pre-tax increase/(decrease) in surplus/(deficit) that would result from the noted percentages in listed exchange

Mr. J George 4 - 12 - 12 15 rates, all other factors remaining constant.

Mr. G Abrahams * 5 - - - - -

Ms M Mbonambi 2 - 6 - 6 6 Foreign Currency Sensitivity

38 41 The following table details the entities sensitivity to a change in the South African Rand against the respective

* this member serves on a pro bono basis foreign currencies. As the risks are symmetrical in nature, a strengthening or weakening of the South African

12. EMPLOYEE BENEFITS Rand would result in an equal but opposite amount to that detailed in the sensitivity analysis below:

Defined Contribution Plan

Included in payroll costs are contributions to a defined contribution retirement plan in respect of services in 2018 2017

a particular period. Contributions made by the entity are charged to the statement of financial performance R'000 R'000

as they are incurred. 2018 2017

USD: -13% (2017: -10%) 11,79 13,40 (130) 380

The total entity contribution to such schemes for the year amounted to R 572,704 (2017: R 454,465).

The funds cover the eligible employees, other than those employees who opt to be or are required by EUR: 1% (2017: -15%) 14,49 14,32 2 14

legislation to be members of various Industry Funds.

Medical Aid CHF: -12% (2017: -14%) 12,37 13,93 2 1

The company contributes to a Medical Aid scheme for employees. The costs of these contributions, which

are charged to the statement of financial performance as they are incurred. Foreign Currency Risk

Financial Assets

The total entity contributions to such schemes for the year amounted to R195,361 (2017: R 177,450). USD 1 029 389

13. SURPLUS/(DEFICIT) FROM OPERATIONS 2018 2017 Financial Liabilities

R'000 R'000 USD 26 4 185

Surplus from operations has been arrived at af er the following: EUR 182 95

Revenue CHF 13 8

Interest received 143 139

Doping control sales 2 859 3 939 Interest Rate Risk

Government grants 22 991 21 896 The entity is not exposed to any interest rate risk on its financial liabilities. Short-term cash surpluses are

Profit/(loss)on foreign exchange (280) 330 deposited with a commercial bank of a high quality credit standing. These deposits at ract interest at rates

Expenditure linked directly to the prime overdraf rate. The entity is also exposed to future cash flow fluctuation risk due to

Auditor's remuneration 915 952 changes in variable market interest rates.

Internal audit fees 165 379

Amortisation of intangible assets 2 2 Interest Rate Sensitivity

Depreciation of property, plant and equipment 276 274 The following table details the entities sensitivity to an increase in the interest rate payable on deposits held by

Directors' remuneration 1 461 1 328 financial institutions. As the risks are symmetrical in nature, a decrease in the interest rate would result in an

Laboratory analysis 4 005 5 100 equal but opposite amount. The cash flow risk associated with net cash is such that an increase/(decrease) of

Courier costs 1 570 2 486 100 basis points in interest rates at the reporting date would have impacted surplus/(deficit) for the year by:

DCO travel, accommodation and reimbursement 2 736 3 683

Doping control purchases 913 1 011 Cash 26 65

87 | South African Institute for Drug-Free Sport South African Institute for Drug-Free Sport | 88