Page 27 - Jignyasa-June 2020

P. 27

Residential Status for

Individuals under Indian

Income Tax Act - Impact of

Recent Amendments

Vanshika Dharod and CA Niraj Chheda

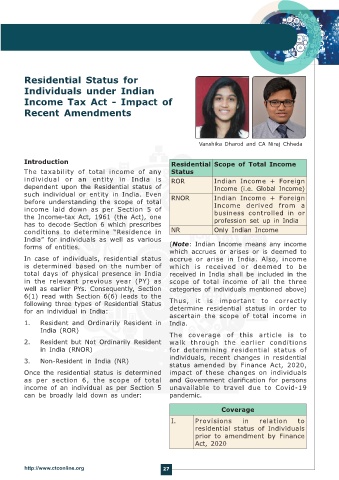

Introduction Residential Scope of Total Income

The taxability of total income of any Status

individual or an entity in India is ROR Indian Income + Foreign

dependent upon the Residential status of Income (i.e. Global Income)

such individual or entity in India. Even

before understanding the scope of total RNOR Indian Income + Foreign

Income derived from a

income laid down as per Section 5 of business controlled in or

the Income-tax Act, 1961 (the Act), one profession set up in India

has to decode Section 6 which prescribes

conditions to determine “Residence in NR Only Indian Income

India” for individuals as well as various

forms of entities. (Note: Indian Income means any income

which accrues or arises or is deemed to

In case of individuals, residential status accrue or arise in India. Also, income

is determined based on the number of which is received or deemed to be

total days of physical presence in India received in India shall be included in the

in the relevant previous year (PY) as scope of total income of all the three

well as earlier PYs. Consequently, Section categories of individuals mentioned above)

6(1) read with Section 6(6) leads to the

following three types of Residential Status Thus, it is important to correctly

for an individual in India: determine residential status in order to

ascertain the scope of total income in

1. Resident and Ordinarily Resident in India.

India (ROR)

The coverage of this article is to

2. Resident but Not Ordinarily Resident walk through the earlier conditions

in India (RNOR) for determining residential status of

3. Non-Resident in India (NR) individuals, recent changes in residential

status amended by Finance Act, 2020,

Once the residential status is determined impact of these changes on individuals

as per section 6, the scope of total and Government clarification for persons

income of an individual as per Section 5 unavailable to travel due to Covid-19

can be broadly laid down as under: pandemic.

Coverage

I. Provisions in relation to

residential status of Individuals

prior to amendment by Finance

Act, 2020

http://www.ctconline.org 27