Page 28 - Jignyasa-June 2020

P. 28

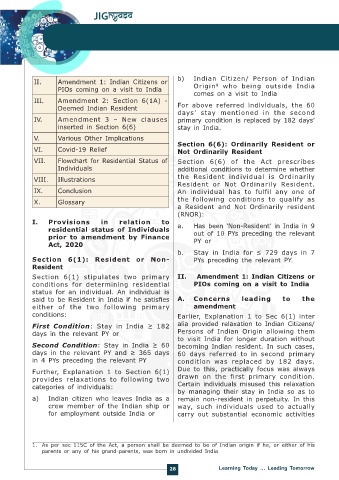

II. Amendment 1: Indian Citizens or b) Indian Citizen/ Person of Indian

1

PIOs coming on a visit to India Origin who being outside India

comes on a visit to India

III. Amendment 2: Section 6(1A) -

Deemed Indian Resident For above referred individuals, the 60

days’ stay mentioned in the second

IV. Amendment 3 – New clauses primary condition is replaced by 182 days’

inserted in Section 6(6) stay in India.

V. Various Other Implications

Section 6(6): Ordinarily Resident or

VI. Covid-19 Relief Not Ordinarily Resident

VII. Flowchart for Residential Status of Section 6(6) of the Act prescribes

Individuals additional conditions to determine whether

VIII. Illustrations the Resident individual is Ordinarily

Resident or Not Ordinarily Resident.

IX. Conclusion An individual has to fulfil any one of

X. Glossary the following conditions to qualify as

a Resident and Not Ordinarily resident

(RNOR):

I. Provisions in relation to a. Has been ‘Non-Resident’ in India in 9

residential status of Individuals

prior to amendment by Finance out of 10 PYs preceding the relevant

Act, 2020 PY or

b. Stay in India for ≤ 729 days in 7

Section 6(1): Resident or Non- PYs preceding the relevant PY.

Resident

Section 6(1) stipulates two primary II. Amendment 1: Indian Citizens or

conditions for determining residential PIOs coming on a visit to India

status for an individual. An individual is

said to be Resident in India if he satisfies A. Concerns leading to the

either of the two following primary amendment

conditions: Earlier, Explanation 1 to Sec 6(1) inter

First Condition: Stay in India ≥ 182 alia provided relaxation to Indian Citizens/

days in the relevant PY or Persons of Indian Origin allowing them

to visit India for longer duration without

Second Condition: Stay in India ≥ 60 becoming Indian resident. In such cases,

days in the relevant PY and ≥ 365 days 60 days referred to in second primary

in 4 PYs preceding the relevant PY condition was replaced by 182 days.

Further, Explanation 1 to Section 6(1) Due to this, practically focus was always

provides relaxations to following two drawn on the first primary condition.

categories of individuals: Certain individuals misused this relaxation

by managing their stay in India so as to

a) Indian citizen who leaves India as a remain non-resident in perpetuity. In this

crew member of the Indian ship or way, such individuals used to actually

for employment outside India or carry out substantial economic activities

1. As per sec 115C of the Act, a person shall be deemed to be of Indian origin if he, or either of his

parents or any of his grand-parents, was born in undivided India

28 Learning Today … Leading Tomorrow