Page 57 - Approved Annual Budget FY 2019-2020_Flat

P. 57

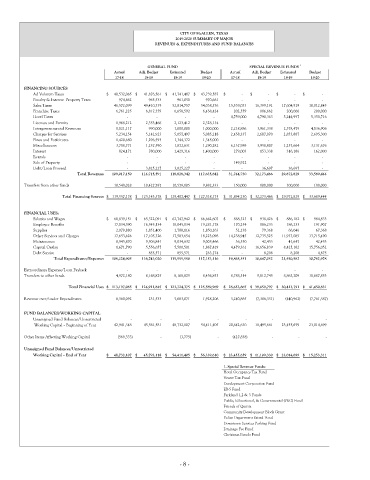

CITY OF McALLEN, TEXAS

2019-2020 SUMMARY OF MAJOR

REVENUES & EXPENDITURES AND FUND BALANCES

GENERAL FUND SPECIAL REVENUE FUNDS 1

Actual Adj. Budget Estimated Budget Actual Adj. Budget Estimated Budget

17-18 18-19 18-19 19-20 17-18 18-19 18-19 19-20

FINANCING SOURCES

Ad Valorem Taxes $ 40,532,065 $ 41,876,561 $ 41,741,487 $ 43,739,587 $ - $ - $ - $ -

Penalty & Interest Property Taxes 974,662 965,533 961,050 970,661 - - - -

Sales Taxes 46,572,099 49,410,339 52,814,757 54,038,536 15,539,033 16,399,191 17,604,919 18,012,845

Franchise Taxes 6,761,225 6,817,359 6,658,592 6,438,424 202,559 186,662 200,000 200,000

Hotel Taxes - - - - 4,759,000 4,790,363 5,244,997 5,350,716

Licenses and Permits 1,968,212 2,353,466 2,123,412 2,328,134 - - - -

Intergovernmental Revenues 1,021,117 990,000 1,000,000 1,000,000 2,218,886 3,961,338 2,378,479 4,036,906

Charges for Services 5,234,154 5,142,923 5,057,497 5,085,218 2,458,337 2,687,070 2,853,887 2,695,300

Fines and Forfeitures 1,420,680 1,296,593 1,344,372 1,345,000 - - - -

Miscellaneous 3,708,771 1,257,590 1,872,631 1,290,282 6,137,989 3,958,807 1,237,664 3,131,676

Interest 824,171 780,000 1,429,316 1,400,000 279,003 153,338 316,186 162,000

Rentals - - - - - - - -

Sale of Property - - - - 149,922 - - -

Debt/Loan Proceed - 3,825,227 3,825,227 - - 36,697 36,697 -

Total Revenues 109,017,150 114,715,591 118,828,342 117,635,842 31,744,730 32,173,466 29,872,829 33,589,444

Transfers from other funds 10,540,028 10,427,787 10,579,105 9,882,333 150,000 100,000 100,000 100,000

Total Financing Sources $ 119,557,178 $ 125,143,378 $ 129,407,447 $ 127,518,175 $ 31,894,730 $ 32,273,466 $ 29,972,829 $ 33,689,444

FINANCIAL USES:

Salaries and Wages $ 60,839,151 $ 65,322,091 $ 62,747,942 $ 66,662,607 $ 888,323 $ 938,426 $ 886,182 $ 984,833

Employee Benefits 17,034,590 16,545,134 18,045,134 19,281,178 170,254 186,233 186,233 191,907

Supplies 2,079,880 1,851,400 1,788,116 1,850,163 52,138 79,368 66,046 67,368

Other Services and Charges 17,653,626 17,105,326 17,583,654 18,223,098 14,238,945 12,735,525 11,937,085 13,715,490

Maintenance 8,945,870 9,506,841 9,034,632 9,005,466 36,530 42,453 41,647 42,453

Capital Outlay 1,671,790 5,556,657 5,500,501 1,867,429 4,479,361 16,656,839 8,425,182 15,756,052

Debt Service - 855,571 855,571 263,174 - 8,208 8,208 4,875

Total Expenditures/Expenses 108,224,905 116,743,020 115,555,550 117,153,116 19,865,551 30,647,052 21,550,582 30,762,978

Extraordinary Expense/Loan Payback - - - - - - - -

Transfers to other funds 4,972,180 8,168,825 8,168,825 8,436,853 8,788,314 9,012,745 8,863,209 10,687,853

Total Financial Uses $ 113,197,085 $ 124,911,845 $ 123,724,375 $ 125,589,969 $ 28,653,865 $ 39,659,797 $ 30,413,791 $ 41,450,831

Revenue over/under Expenditures 6,360,092 231,533 5,683,071 1,928,206 3,240,865 (7,386,331) (440,962) (7,761,387)

FUND BALANCES/WORKING CAPITAL

-

Unassigned Fund Balances/Unrestricted - - - - - - -

Working Capital -- Beginning of Year 42,941,348 45,561,581 48,732,107 54,411,405 20,642,630 18,495,661 23,455,659 23,014,699

Other Items Affecting Working Capital (569,333) (3,775) - (427,838) - - -

-

Unassigned Fund Balances/Unrestricted

Working Capital -- End of Year $ 48,732,107 $ 45,793,118 $ 54,411,405 $ 56,339,610 $ 23,455,659 $ 11,109,330 $ 23,014,699 $ 15,253,311

1. Special Revenue Funds:

Hotel Occupancy Tax Fund

Venue Tax Fund

Development Corporation Fund

EB-5 Fund

Parkland 1,2 & 3 Funds

Public, Educational, & Governmental (PEG) Fund

Friends of Quinta

Community Development Block Grant

Police Department Seized Fund

Downtown Services Parking Fund

Drainage Fee Fund

Christmas Parade Fund

- 8 -