Page 377 - Budget Book FY2020-2021

P. 377

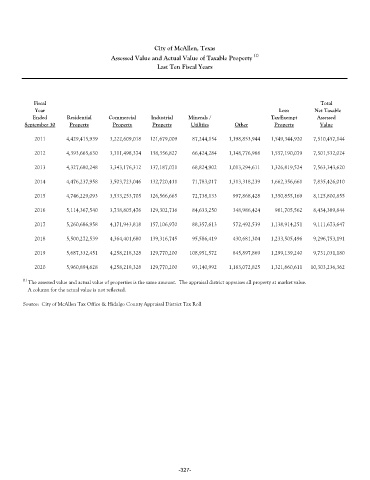

City of McAllen, Texas

Assessed Value and Actual Value of Taxable Property (1)

Last Ten Fiscal Years

Fiscal Total

Year Less: Net Taxable

Ended Residential Commercial Industrial Minerals / Tax-Exempt Assessed

September 30 Property Property Property Utilities Other Property Value

2011 4,429,415,939 3,222,609,018 121,679,009 87,244,154 1,198,853,944 1,549,344,920 7,510,457,144

2012 4,393,665,630 3,311,498,374 138,356,827 66,424,284 1,148,776,988 1,557,190,079 7,501,532,024

2013 4,327,680,248 3,343,176,312 137,187,071 68,824,902 1,013,294,611 1,326,819,524 7,563,343,620

2014 4,476,237,958 3,503,723,046 132,720,411 71,783,017 1,313,318,239 1,662,356,661 7,835,426,010

2015 4,746,229,093 3,533,253,705 126,566,665 72,738,133 997,868,428 1,350,855,169 8,125,800,855

2016 5,114,367,540 3,738,805,476 129,302,716 84,633,250 348,986,424 981,705,562 8,434,389,844

2017 5,260,686,958 4,171,943,818 157,106,970 88,357,613 572,492,539 1,138,914,251 9,111,673,647

2018 5,500,272,539 4,364,401,680 139,316,745 95,586,419 430,681,304 1,233,505,496 9,296,753,191

2019 5,687,332,451 4,258,218,328 129,770,200 108,951,572 845,897,869 1,299,139,240 9,731,031,180

2020 5,960,894,628 4,258,218,328 129,770,200 93,140,992 1,183,072,825 1,321,860,611 10,303,236,362

(1)

The assessed value and actual value of properties is the same amount. The appraisal district appraises all property at market value.

A column for the actual value is not reflected.

Source: City of McAllen Tax Office & Hidalgo County Appraisal District Tax Roll

-327-