Page 58 - Budget Book FY2020-2021

P. 58

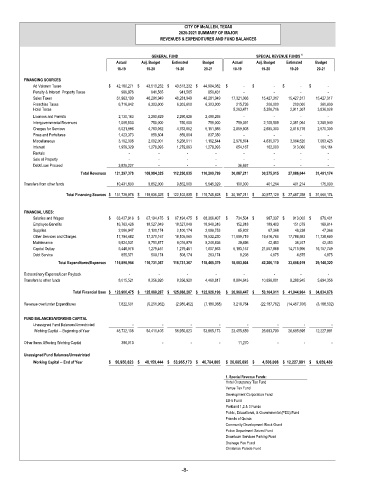

CITY OF McALLEN, TEXAS

2020-2021 SUMMARY OF MAJOR

REVENUES & EXPENDITURES AND FUND BALANCES

GENERAL FUND SPECIAL REVENUE FUNDS 1

Actual Adj. Budget Estimated Budget Actual Adj. Budget Estimated Budget

18-19 19-20 19-20 20-21 18-19 19-20 19-20 20-21

FINANCING SOURCES

Ad Valorem Taxes $ 42,160,271 $ 43,513,232 $ 43,513,232 $ 44,994,082 $ - $ - $ - $ -

Penalty & Interest Property Taxes 989,976 941,565 941,565 950,431 - - - -

Sales Taxes 51,963,199 46,281,949 46,281,949 46,281,949 17,321,066 15,427,317 15,427,317 15,427,317

Franchise Taxes 6,716,042 6,303,000 6,303,000 6,303,000 215,736 200,000 200,000 200,000

Hotel Taxes - - - - 5,263,471 5,350,716 2,911,307 3,836,028

Licenses and Permits 2,130,163 2,290,629 2,290,628 2,490,265 - - - -

Intergovernmental Revenues 1,005,503 750,000 750,000 750,000 759,391 2,105,509 2,351,064 2,289,940

Charges for Services 6,021,986 4,763,052 4,763,052 5,151,985 2,859,808 2,695,300 2,818,776 2,570,300

Fines and Forfeitures 1,423,373 859,804 859,804 837,350 - - - -

Miscellaneous 3,102,306 2,002,001 5,268,511 1,162,644 2,976,874 4,635,073 3,064,520 7,063,425

Interest 1,959,329 1,279,093 1,279,093 1,279,093 654,167 162,000 313,060 104,164

Rentals - - - - - - - -

Sale of Property - - - - - - - -

Debt/Loan Proceed 3,825,227 - - - 36,697 - - -

Total Revenues 121,297,378 108,984,325 112,250,835 110,200,799 30,087,211 30,575,915 27,086,044 31,491,174

Transfers from other funds 10,431,600 9,852,000 9,852,000 5,545,029 100,000 401,214 401,214 175,000

Total Financing Sources $ 131,728,978 $ 118,836,325 $ 122,102,835 $ 115,745,828 $ 30,187,211 $ 30,977,129 $ 27,487,258 $ 31,666,174

FINANCIAL USES:

Salaries and Wages $ 63,427,918 $ 67,194,475 $ 67,194,475 $ 68,366,407 $ 734,504 $ 987,337 $ 913,002 $ 979,401

Employee Benefits 16,763,426 18,527,049 18,527,049 18,948,316 152,918 189,403 151,079 169,814

Supplies 2,086,947 2,100,174 2,100,174 2,098,753 65,802 67,368 46,238 47,368

Other Services and Charges 17,784,482 17,370,167 18,105,065 18,532,230 11,899,719 19,416,786 17,786,583 11,738,660

Maintenance 9,524,531 9,751,877 9,016,979 9,248,836 39,496 42,453 38,247 42,453

Capital Outlay 5,448,078 1,279,451 1,279,451 1,007,663 5,183,157 21,557,888 14,715,995 16,157,749

Debt Service 855,571 508,174 508,174 263,174 8,208 4,875 4,875 4,875

Total Expenditures/Expenses 115,890,954 116,731,367 116,731,367 118,465,379 18,083,804 42,266,110 33,656,019 29,140,320

Extraordinary Expense/Loan Payback - - - - - - - -

Transfers to other funds 8,015,521 8,356,920 8,356,920 4,460,817 8,884,643 10,898,801 8,288,945 5,694,356

Total Financial Uses $ 123,906,475 $ 125,088,287 $ 125,088,287 $ 122,926,196 $ 26,968,447 $ 53,164,911 $ 41,944,964 $ 34,834,676

Revenue over/under Expenditures 7,822,501 (6,251,962) (2,985,452) (7,180,368) 3,218,764 (22,187,782) (14,457,706) (3,168,502)

FUND BALANCES/WORKING CAPITAL

Unassigned Fund Balances/Unrestricted - - - - - - - -

Working Capital -- Beginning of Year 48,732,108 54,411,405 56,950,623 53,965,173 23,455,659 26,693,790 26,685,695 12,227,991

Other Items Affecting Working Capital 396,013 - - - 11,270 - - -

Unassigned Fund Balances/Unrestricted

Working Capital -- End of Year $ 56,950,623 $ 48,159,444 $ 53,965,173 $ 46,784,805 $ 26,685,695 $ 4,506,008 $ 12,227,991 $ 9,059,489

1. Special Revenue Funds:

Hotel Occupancy Tax Fund

Venue Tax Fund

Development Corporation Fund

EB-5 Fund

Parkland 1,2 & 3 Funds

Public, Educational, & Governmental (PEG) Fund

Friends of Quinta

Community Development Block Grant

Police Department Seized Fund

Downtown Services Parking Fund

Drainage Fee Fund

Christmas Parade Fund

-8-