Page 13 - Motorcycle Trader (February 2020)

P. 13

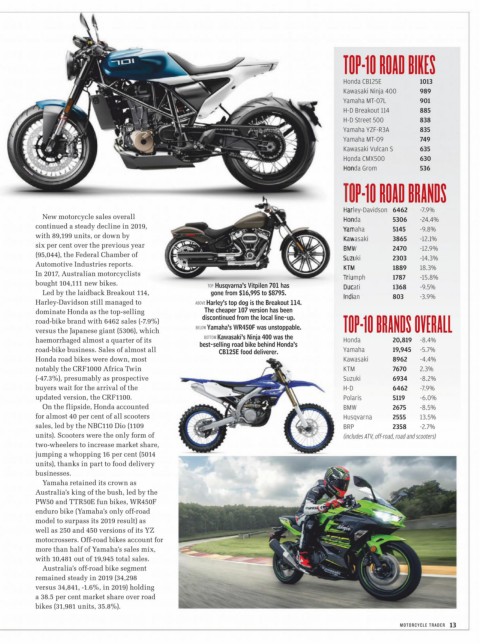

TOP-10 ROAD BIKES

Honda CB125E 1013

Kawasaki Ninja 400 989

Yamaha MT-07L 901

H-D Breakout 114 885

H-D Street 500 838

Yamaha YZF-R3A 835

Yamaha MT-09 749

Kawasaki Vulcan S 635

Honda CMX500 630

da Grom 536

P-10 ROAD BRANDS

ey-Davidson 6462 -7.9%

New motorcycle sales overall da 5306 -24.4%

continued a steady decline in 2019, maha 5145 -9.8%

with 89,199 units, or down by asaki 3865 -12.1%

six per cent over the previous year W 2470 -12.9%

(95,044), the Federal Chamber of uki 2303 -14.3%

Automotive Industries reports. M 1889 18.3%

In 2017, Australian motorcyclists mph 1787 -15.8%

bought 104,111 new bikes. TOP Husqvarna’s Vitpilen 701 has ati 1368 -9.5%

Led by the laidback Breakout 114, gone from $16,995 to $8795. an 803 -3.9%

Harley-Davidson still managed to ABOVE Harley’s top dog is the Breakout 114.

dominate Honda as the top-selling The cheaper 107 version has been

road-bike brand with 6462 sales (-7.9%) discontinued from the local line-up. TOP-10 BRANDS OVERALL

versus the Japanese giant (5306), which BELOW Yamaha’s WR450F was unstoppable.

BOTTOM Kawasaki’s Ninja 400 was the

haemorrhaged almost a quarter of its best-selling road bike behind Honda’s Honda 20,819 -8.4%

road-bike business. Sales of almost all CB125E food deliverer. Yamaha 19,945 -5.7%

Honda road bikes were down, most Kawasaki 8962 -4.4%

notably the CRF1000 Africa Twin KTM 7670 2.3%

(-47.3%), presumably as prospective Suzuki 6934 -8.2%

buyers wait for the arrival of the H-D 6462 -7.9%

updated version, the CRF1100. Polaris 5119 -6.0%

On the flipside, Honda accounted BMW 2675 -8.5%

for almost 40 per cent of all scooters Husqvarna 2555 13.5%

sales, led by the NBC110 Dio (1109 BRP 2358 -2.7%

units). Scooters were the only form of (includes ATV, off-road, road and scooters)

two-wheelers to increase market share,

jumping a whopping 16 per cent (5014

units), thanks in part to food delivery

businesses.

Yamaha retained its crown as

Australia’s king of the bush, led by the

PW50 and TTR50E fun bikes, WR450F

enduro bike (Yamaha’s only off-road

model to surpass its 2019 result) as

well as 250 and 450 versions of its YZ

motocrossers. Off-road bikes account for

more than half of Yamaha’s sales mix,

with 10,481 out of 19,945 total sales.

Australia’s off-road bike segment

remained steady in 2019 (34,298

versus 34,841, -1.6%, in 2019) holding

a 38.5 per cent market share over road

bikes (31,981 units, 35.8%).

MOTORCYCLE TRADER 13