Page 29 - gmj140-Jul-Sept-mag-web_Neat

P. 29

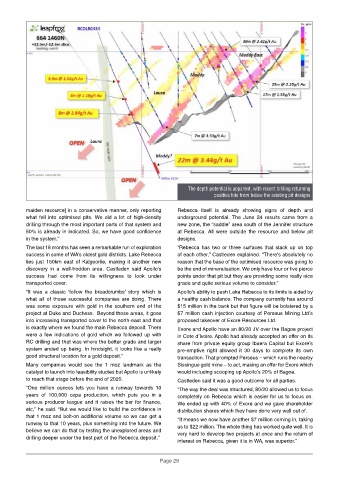

The depth potential is apparent, with recent drilling returning

positive hits from below the existing pit designs

maiden resource] in a conservative manner, only reporting Rebecca itself is already showing signs of depth and

what fell into optimised pits. We did a lot of high-density underground potential. The June 24 results came from a

drilling through the most important parts of that system and new zone, the “saddle” area south of the Jennifer structure

50% is already in indicated. So, we have good confidence at Rebecca. All were outside the resource and below pit

in the system.” designs.

The last 18 months has seen a remarkable run of exploration “Rebecca has two or three surfaces that stack up on top

success in some of WA’s oldest gold districts. Lake Rebecca of each other,” Castleden explained. “There’s absolutely no

lies just 150km east of Kalgoorlie, making it another new reason that the base of the optimised resource was going to

discovery in a well-trodden area. Castleden said Apollo’s be the end of mineralisation. We only have four or five pierce

success had come from its willingness to look under points under that pit but they are providing some really nice

transported cover. grade and quite serious volume to consider.”

“It was a classic ‘follow the breadcrumbs’ story which is Apollo’s ability to push Lake Rebecca to its limits is aided by

what all of those successful companies are doing. There a healthy cash balance. The company currently has around

was some exposure with gold in the southern end of the $15 million in the bank but that figure will be bolstered by a

project at Duke and Duchess. Beyond those areas, it goes $7 million cash injection courtesy of Perseus Mining Ltd’s

into increasing transported cover to the north-east and that proposed takeover of Exore Resources Ltd.

is exactly where we found the main Rebecca deposit. There Exore and Apollo have an 80/20 JV over the Bagoe project

were a few indications of gold which we followed up with in Cote d’Ivoire. Apollo had already accepted an offer on its

RC drilling and that was where the better grade and larger share from private equity group Ibaera Capital but Exore’s

system ended up being. In hindsight, it looks like a really pre-emptive right allowed it 30 days to complete its own

good structural location for a gold deposit.” transaction. That prompted Perseus – which runs the nearby

Many companies would see the 1 moz landmark as the Sissingue gold mine – to act, making an offer for Exore which

catalyst to launch into feasibility studies but Apollo is unlikely would including scooping up Apollo’s 20% of Bagoe.

to reach that stage before the end of 2020. Castleden said it was a good outcome for all parties.

“One million ounces lets you have a runway towards 10 “The way the deal was structured, 80/20 allowed us to focus

years of 100,000 ozpa production, which puts you in a completely on Rebecca which is easier for us to focus on.

serious producer league and it raises the bar for finance, We ended up with 40% of Exore and we gave shareholder

etc,” he said. “But we would like to build the confidence in distribution shares which they have done very well out of.

that 1 moz and bolt-on additional volume so we can get a

“It means we now have another $7 million coming in, taking

runway to that 10 years, plus something into the future. We

us to $22 million. The whole thing has worked quite well. It is

believe we can do that by testing the unexplored areas and

very hard to develop two projects at once and the return of

drilling deeper under the best part of the Rebecca deposit.”

interest on Rebecca, given it is in WA, was superior.”

Page 29