Page 69 - pd307-Aug22-mag-web-Neat

P. 69

operation. Everything we have applied for

has happened in a reasonable timeframe

and it is a pleasure to work there.”

Adding to the growing interest in the belt

has been Sandfire Resources Ltd’s suc-

cess with its Motheo copper project (see

page 20) and the ongoing development of

the Khomecau copper mine, which is re-

portedly up for sale.

Holland believes the attention generated

by those two projects will spread to Cobre’s

own portfolio.

“Sandfire will soon have its mine running

and there is rumoured M&A activity in the

area with Khomecau apparently on the

market,” he said. “We have already fielded

inquiries from majors.”

With the copper development pipeline

as dry as it has ever been, major produc-

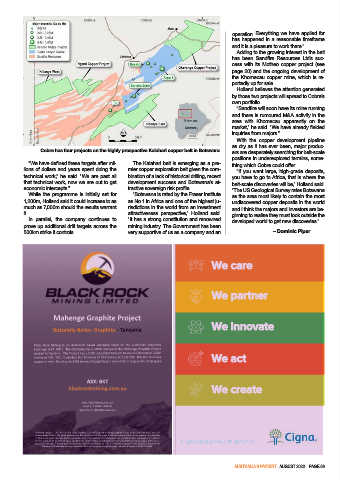

Cobre has four projects on the highly prospective Kalahari copper belt in Botswana

ers are desperately searching for belt-scale

positions in underexplored terrains, some-

“We have defined these targets after mil- The Kalahari belt is emerging as a pre- thing which Cobre could offer.

lions of dollars and years spent doing the mier copper exploration belt given the com- “If you want large, high-grade deposits,

technical work,” he said. “We are past all bination of a lack of historical drilling, recent you have to go to Africa, that is where the

that technical work, now we are out to get development success and Botswana’s at- belt-scale discoveries will be,” Holland said.

economic intercepts.” tractive sovereign risk profile. “The US Geological Survey rates Botswana

While the programme is initially set for “Botswana is rated by the Fraser Institute as the area most likely to contain the most

1,200m, Holland said it could increase to as as No.1 in Africa and one of the highest ju- undiscovered copper deposits in the world

much as 7,000m should the results warrant risdictions in the world from an investment and I think the majors and investors are be-

it. attractiveness perspective,” Holland said. ginning to realise they must look outside the

In parallel, the company continues to “It has a strong constitution and renowned developed world to get new discoveries.”

prove up additional drill targets across the mining industry. The Government has been

500km strike it controls. very supportive of us as a company and an – Dominic Piper

We care

We partner

Mahenge Graphite Project

Naturally Beeer Graphite - Tanzania We innovate

Black Rock Mining is an Australian based company listed on the Australian Securiies

Exchange (ASX: BKT). The Company has a 100% interest in the Mahenge Graphite Project

located in Tanzania. The Project has a JORC compliant Mineral Resource Esimate of 213m

tonnes at 7.8% TGC. It also has Ore Reserves of 70m tonnes at 8.5% TGC. The Ore Reserves We act

support a mine life of up to 350k tonnes of graphite per annum for a reserve life of 16 years.

ASX: BKT

blackrockmining.com.au We create

Black Rock Mining Limited

Level 1, 1 Walker Avenue

West Perth, WA 6005 Australia

Following release of the Enhanced Definiive Feasibility Study (DFS) on the Mahenge Graphite Project in July 2019 (see Black Rock ASX

release dated 25 July 2019, Mahenge Enhanced DFS with Execuive Summary), Black Rock confirms that it is not aware of any new data

or informaion that materially affects the results of the Enhanced DFS. All material assumpions and technical parameters, including in

the esimaion of Mineral Resources or Ore Reserves, underpinning the esimates in the Enhanced DFS coninue to apply and have not

materially changed. The esimated Ore Reserves and Mineral Resources underpinning the producion and financial forecasts in the

Enhanced D

Enhanced DFS were prepared by Competent Persons in accordance with the requirements in Appendix 5A (JORC Code).

aUSTRaLIa’S PaYDIRT aUgUST 2022 Page 69