Page 449 - NEWGEN21-Proceedings-Full

P. 449

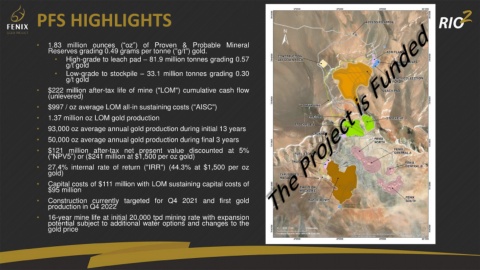

PFS HIGHLIGHTS

• 1.83 million ounces (“oz”) of Proven & Probable Mineral

Reserves grading 0.49 grams per tonne ("g/t") gold.

• High-grade to leach pad – 81.9 million tonnes grading 0.57

g/t gold

• Low-grade to stockpile – 33.1 million tonnes grading 0.30

g/t gold

• $222 million after-tax life of mine ("LOM") cumulative cash flow

(unlevered)

• $997 / oz average LOM all-in sustaining costs ("AISC")

• 1.37 million oz LOM gold production

• 93,000 oz average annual gold production during initial 13 years

• 50,000 oz average annual gold production during final 3 years

• $121 million after-tax net present value discounted at 5%

(“NPV5”) or ($241 million at $1,500 per oz gold)

• 27.4% internal rate of return ("IRR") (44.3% at $1,500 per oz

gold)

• Capital costs of $111 million with LOM sustaining capital costs of

$95 million

• Construction currently targeted for Q4 2021 and first gold

production in Q4 2022

• 16-year mine life at initial 20,000 tpd mining rate with expansion

potential subject to additional water options and changes to the

gold price