Page 23 - pd294-June21-mag-web_Neat

P. 23

This is an industry where there have

been no important discoveries for some

time. The copper industry has a tremendous

cha

“llenge to respond to [coming] demand.

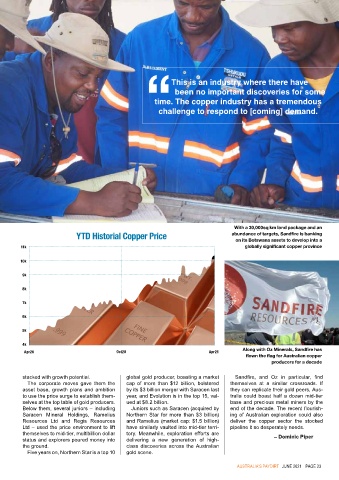

With a 30,000sq km land package and an

YTD Historial Copper Price abundance of targets, Sandfire is banking

on its Botswana assets to develop into a

11k globally significant copper province

10k

9k

8k

7k

6k

5k

4k

Along with Oz Minerals, Sandfire has

Apr20 Oct20 Apr21

flown the flag for Australian copper

producers for a decade

stacked with growth potential. global gold producer, boasting a market Sandfire, and Oz in particular, find

The corporate moves gave them the cap of more than $12 billion, bolstered themselves at a similar crossroads. If

asset base, growth plans and ambition by its $3 billion merger with Saracen last they can replicate their gold peers, Aus-

to use the price surge to establish them- year, and Evolution is in the top 15, val- tralia could boast half a dozen mid-tier

selves at the top table of gold producers. ued at $8.2 billion. base and precious metal miners by the

Below them, several juniors – including Juniors such as Saracen (acquired by end of the decade. The recent flourish-

Saracen Mineral Holdings, Ramelius Northern Star for more than $3 billion) ing of Australian exploration could also

Resources Ltd and Regis Resources and Ramelius (market cap: $1.5 billion) deliver the copper sector the stocked

Ltd – used the price environment to lift have similarly vaulted into mid-tier terri- pipeline it so desperately needs.

themselves to mid-tier, multibillion dollar tory. Meanwhile, exploration efforts are

status and explorers poured money into delivering a new generation of high- – Dominic Piper

the ground. class discoveries across the Australian

Five years on, Northern Star is a top 10 gold scene.

aUSTRaLIa’S PaYDIRT JUNe 2021 Page 23