Page 43 - pd281-Apr20-mag-web_Neat

P. 43

Blackstone isolates

from general market

f there was a list of upbeat mining exec- the nickel sulphide front at Ta Khoa

Iutives going around right now, it would and while the commodity has been

be small given the state of global affairs talked about as a key part of the EV

but despite a share price smashing and story, prices have yet to reflect grow-

nickel’s doldrums Blackstone Minerals ing demand and/or the importance of

Ltd managing director Scott Williamson the metal.

would likely make it on the list. Williamson remains unfazed with

Company-wise there is good reason the dynamics playing out in the nickel

for Williamson’s positive outlook, as the sector for the time being.

last 12 months has seen significant pro- “We have to try and think a bit fur-

gress at the Ta Khoa nickel sulphide pro- ther than the current market. I think

ject, 160km west of Hanoi, Vietnam. the good thing about this is that on Scott Williamson

During this period, Blackstone not only the other side of it we will go into a prop-

acquired Ta Khoa, but raised the pro- er bull market for a change and it will be “Korea is our funding source, so we

ject’s potential to a level not seen in its back on,” he said. don’t have to worry so much about the

recent history. “The EV story isn’t a short-term story, it conventional capital markets; we have

Initially attracted to a mine which pro- is a 2023 story. The reason why the nick- someone much bigger ready to help us,

duced 20,700t nickel and 10,100t cop- el price was running last time was due we’re lucky there,” Williamson said.

per between 2013-2016, Blackstone to the supply constrain out of Indonesia. “We are focusing on that and trying to

has quickly revealed potential value in The demand for EVs doesn’t kick in until get some deals done there. As soon as

palladium-platinum-gold-rhodium-cobalt another 2-3 years which is when we will we get funding out of Korea then there

as by-products, while also making the be mining. For us we are not too worried will be no stopping us because the mar-

high-grade disseminated nickel sulphide about the short-term price because we ket will realise we don’t have to worry

King Cobra discovery (39m @ 1.1% nick- know that in 2-3 years’ time it will be in about fluctuations in share prices.”

el and 28m @ 1.2% nickel latest results). the order of $US20,000/t or more.” A discovery in the ilk of King Cobra –

At the time of print, Blackstone report- Williamson is confident that the nickel Blackstone rose from 12c/share when

ed that drilling was continuing to inter- price will rise above current levels in due King Cobra was announced in Decem-

sect the King Cobra zone over a 200m course, however, if it doesn’t and there ber up to as high as 22c/share on the

strike length, with the discovery remain- is a lag in EV demand, Blackstone can back of follow-up intersections of 60m @

ing open down-dip and long strike to the absorb some of the downside. 1.3% nickel in January – would move the

north-west and south-east. “Palladium and rhodium prices are Blackstone dial in the short term, how-

“The King Cobra discovery brought up [currently] going very well. In a way we ever, there are pending major milestones

the entire grade from surface early on in are sort of hedged if the EV take-up is looming on the horizon.

the mine life. We were expecting to drill slower than expected because we have “Our maiden resource in late Q2 and

something that was going to be 0.5% the palladium-platinum-rhodium that go scoping study in late Q3 is really when

nickel and we’re getting 1% nickel from into an internal combustion engine as a the market will wake up and realise that

surface. You can imagine what that does catalytic converter,” he said. our nickel mine works in any nickel price

to the NPV; doubling the grade so you The clear focus for Blackstone is re- environment because we have nickel

are getting twice as much metal through booting a nickel sulphide project to sup- sulphides, which works in any price en-

early in the mine life,” Williamson said. ply Asia’s growing lithium-ion battery vironment whereas laterites require at

There is clear cause for enthusiasm on industry with Korea’s largest EV battery least $US20,000/t,” Williamson said.

cathode producer “At the moment the market doesn’t

showing interest. quite understand what we have got be-

In December, cause we haven’t put any numbers out.

an alliance be- We have drill hits and will do a block

tween Blackstone model for people to understand what

and Korea’s Eco- the resource looks like and the econom-

pro CM Co. Ltd ics behind it. It will take another three

was struck via a months or so. At that point, that is when

non-binding MoU the market wakes up. If I was putting that

for the potential news into the market now, I wouldn’t be

partnership to very impressed, but I think in 3-6 months

develop a down- we should be in a better market and I’d

stream process- be happy putting that news out then.”

ing facility in as-

sociation with Ta – Mark Andrews

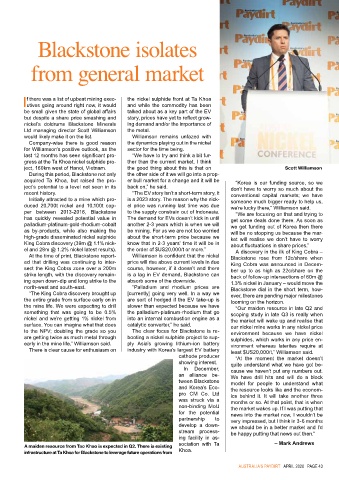

A maiden resource from Tao Khao is expected in Q2. There is existing

infrastructure at Ta Khoa for Blackstone to leverage future operations from Khoa.

aUSTRaLIa’S PaYDIRT aPRIL 2020 Page 43