Page 59 - gmj145-Oct-Dec-mag-web_Neat

P. 59

GMJ: As well as the obvious goals (increased GMJ: How have the Teranga and SEMAFO

value, etc.) what other opportunities will the assets been bedded down? Do they have the

London listing present? look of Endeavour operations now?

SdM: The FTSE indexation was always one of the main SdM: We have successfully completed the acquisitions

reasons behind the premium listing on the LSE and we of Teranga and SEMAFO and integrated our new assets

were therefore pleased with the FTSE announcement in into our well-established West African operating platform

August stating that we will be included into the FTSE 250. and we are on track to realise $US100 million of recurring

It’s a big catalyst, as, from the notes we have seen by the annual synergies from both transactions by year-end.

index analysts, this is expected to create an incremental For Teranga, we were able to leverage the learnings from

demand of circa 10% of our shares outstanding. the recent SEMAFO integration and the team has been

When we set out five years ago, our first priority was to rapidly overlaying Endeavour management model.

appeal to precious metal funds. Given the significant On mine site, we can benefit from being the largest gold

change in our top 20 register, which is now comprised producer in Senegal, Burkina Faso and Côte d’Ivoire and

mainly of blue-chip investors, we have achieved that goal. leverage our existing Burkina Faso platform to support

With the improvement in our portfolio and our larger Wahgnion and Golden Hill.

market cap following the recent acquisitions, we now

have an attractive business and enhanced capital GMJ: You have managed to stay on guidance

despite the challenges of COVID. How was

markets profile required to attract large generalist funds.

We are now able to appeal to those with a wide array of that achieved and how much interaction and

knowledge-sharing has there been with peers

investment strategies and a listing in London allows us to

reach those investors. in the region?

We are excited about all that lies ahead and what we can SdM: As you might expect we have been closely

offer existing and prospective investors as a constituent of collaborating with local governments and communities

the LSE. With its commitment to gold standard corporate as well as peers as we were all facing the health crisis

governance framework, the Premium segment of the LSE to ensure we can implement best practice and support

provides a natural venue for Endeavour at this juncture in teams and communities as best as possible.

its continuing evolution.

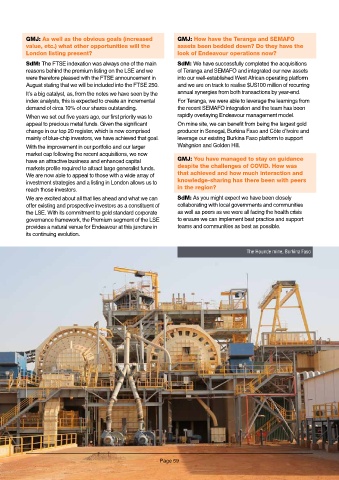

The Hounde mine, Burkina Faso

Page 59