Page 81 - Learn Africa 2021 Annual Report

P. 81

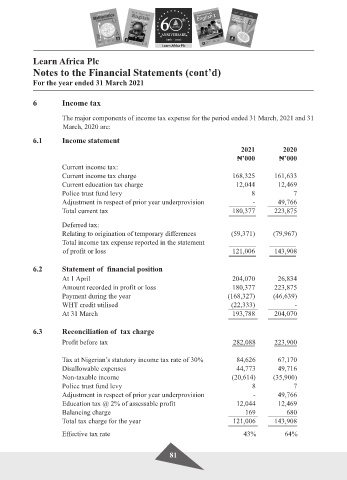

Learn Africa Plc

Notes to the Financial Statements (cont’d)

For the year ended 31 March 2021

6 Income tax

The major components of income tax expense for the period ended 31 March, 2021 and 31

March, 2020 are:

6.1 Income statement

2021 2020

$’000 $’000

Current income tax:

Current income tax charge 168,325 161,633

Current education tax charge 12,044 12,469

Police trust fund levy 8 7

Adjustment in respect of prior year underprovision - 49,766

Total current tax 180,377 223,875

Deferred tax:

Relating to origination of temporary differences (59,371) (79,967)

Total income tax expense reported in the statement

of profit or loss 121,006 143,908

6.2 Statement of financial position

At 1 April 204,070 26,834

Amount recorded in profit or loss 180,377 223,875

Payment during the year (168,327) (46,639)

WHT credit utilised (22,333) -

At 31 March 193,788 204,070

6.3 Reconciliation of tax charge

Profit before tax 282,088 223,900

Tax at Nigerian’s statutory income tax rate of 30% 84,626 67,170

Disallowable expenses 44,773 49,716

Non-taxable income (20,614) (35,900)

Police trust fund levy 8 7

Adjustment in respect of prior year underprovision - 49,766

Education tax @ 2% of assessable profit 12,044 12,469

Balancing charge 169 680

Total tax charge for the year 121,006 143,908

Effective tax rate 43% 64%

81