Page 82 - Learn Africa 2021 Annual Report

P. 82

Learn Africa Plc

Notes to the Financial Statements (cont’d)

For the year ended 31 March 2021

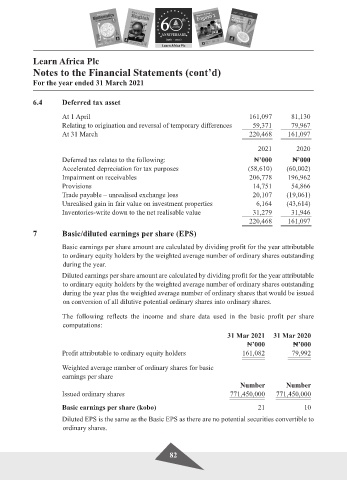

6.4 Deferred tax asset

At 1 April 161,097 81,130

Relating to origination and reversal of temporary differences 59,371 79,967

At 31 March 220,468 161,097

2021 2020

Deferred tax relates to the following: $’000 $’000

Accelerated depreciation for tax purposes (58,610) (60,002)

Impairment on receivables 206,778 196,962

Provisions 14,751 54,866

Trade payable – unrealised exchange loss 20,107 (19,061)

Unrealised gain in fair value on investment properties 6,164 (43,614)

Inventories-write down to the net realisable value 31,279 31,946

220,468 161,097

7 Basic/diluted earnings per share (EPS)

Basic earnings per share amount are calculated by dividing profit for the year attributable

to ordinary equity holders by the weighted average number of ordinary shares outstanding

during the year.

Diluted earnings per share amount are calculated by dividing profit for the year attributable

to ordinary equity holders by the weighted average number of ordinary shares outstanding

during the year plus the weighted average number of ordinary shares that would be issued

on conversion of all dilutive potential ordinary shares into ordinary shares.

The following reflects the income and share data used in the basic profit per share

computations:

31 Mar 2021 31 Mar 2020

$’000 $’000

Profit attributable to ordinary equity holders 161,082 79,992

Weighted average number of ordinary shares for basic

earnings per share

Number Number

Issued ordinary shares 771,450,000 771,450,000

Basic earnings per share (kobo) 21 10

Diluted EPS is the same as the Basic EPS as there are no potential securities convertible to

ordinary shares.

82