Page 61 - Year-Long Plan_Neat

P. 61

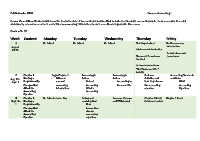

25 Chapter 14 – Recording loss of Journalizing uncollectible Promissory Notes Work Day Promissory Notes

Feb. 13 - Accounting for uncollectable account receivable

17 Uncollectable accounts

Accounts

Receivable

26 Chapter 15 – No School – Adjusting Account Balances Adjusting Merchandising Calculating Federal Adjusting Accumulated

Feb. 20 - Preparing President’s Day Inventory and Interest Income Tax Depreciation

24 Adjusting Receivable

Entries and a

Trail Balance

27 Chapters 14 Chapter 14 and 15 Chapter 14 and 15 Chapter 16 – Financial Financial Statements Preparing a statement of

Feb. 27 and 15 Review Study Guide and Exam Statements and Closing - Preparing an stockholder’s equity

– March and Exam Review Entries for a Corporation income

3 statement

Begin Chapter from a trail

16 balance

28 Chapter 16 – Preparing a balance sheet Work Day Recording closing entries Preparing a post-closing Storm Make-up Day – No

March 6 Financial for income statement trail balance School

- 10 Statements accounts

and Closing

Entries for a

Corporation

29 Chapter 17 – Storm Make-up Vertical analysis ratios Vertical analysis of a Vertical analysis of a Horizontal analysis

March Financial Day – No School balance sheet balance sheet

13 - 17 Statement

Analysis

30 Chapter 17 – Earnings per Earnings per share, Work Day Chapter 16 and Chapter 16 and 17 Exam

March Financial share, market market ratios, 17 study guide

20 - 24 Statement ratios, liquidity liquidity ratios and review

End of Analysis ratios

rd

3 9

wks