Page 117 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 117

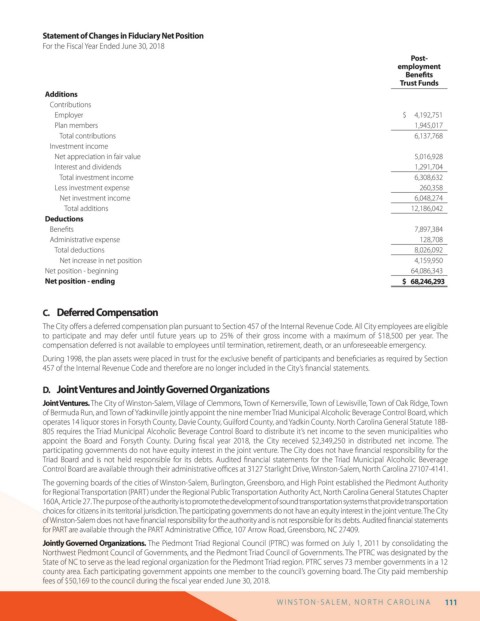

Statement of Changes in Fiduciary Net Position

For the Fiscal Year Ended June 30, 2018

Post-

employment

Bene ts

Trust Funds

Additions

Contributions

Employer $ 4,192,751

Plan members 1,945,017

Total contributions 6,137,768

Investment income

Net appreciation in fair value 5,016,928

Interest and dividends 1,291,704

Total investment income 6,308,632

Less investment expense 260,358

Net investment income 6,048,274

Total additions 12,186,042

Deductions

Bene ts 7,897,384

Administrative expense 128,708

Total deductions 8,026,092

Net increase in net position 4,159,950

Net position - beginning 64,086,343

Net position - ending $ 68,246,293

C. Deferred Compensation

The City o ers a deferred compensation plan pursuant to Section 457 of the Internal Revenue Code. All City employees are eligible

to participate and may defer until future years up to 25% of their gross income with a maximum of $18,500 per year. The

compensation deferred is not available to employees until termination, retirement, death, or an unforeseeable emergency.

During 1998, the plan assets were placed in trust for the exclusive bene t of participants and bene ciaries as required by Section

457 of the Internal Revenue Code and therefore are no longer included in the City’s nancial statements.

D. Joint Ventures and Jointly Governed Organizations

Joint Ventures. The City of Winston-Salem, Village of Clemmons, Town of Kernersville, Town of Lewisville, Town of Oak Ridge, Town

of Bermuda Run, and Town of Yadkinville jointly appoint the nine member Triad Municipal Alcoholic Beverage Control Board, which

operates 14 liquor stores in Forsyth County, Davie County, Guilford County, and Yadkin County. North Carolina General Statute 18B-

805 requires the Triad Municipal Alcoholic Beverage Control Board to distribute it’s net income to the seven municipalities who

appoint the Board and Forsyth County. During scal year 2018, the City received $2,349,250 in distributed net income. The

participating governments do not have equity interest in the joint venture. The City does not have nancial responsibility for the

Triad Board and is not held responsible for its debts. Audited nancial statements for the Triad Municipal Alcoholic Beverage

Control Board are available through their administrative o ces at 3127 Starlight Drive, Winston-Salem, North Carolina 27107-4141.

The governing boards of the cities of Winston-Salem, Burlington, Greensboro, and High Point established the Piedmont Authority

for Regional Transportation (PART) under the Regional Public Transportation Authority Act, North Carolina General Statutes Chapter

160A, Article 27. The purpose of the authority is to promote the development of sound transportation systems that provide transportation

choices for citizens in its territorial jurisdiction. The participating governments do not have an equity interest in the joint venture. The City

of Winston-Salem does not have nancial responsibility for the authority and is not responsible for its debts. Audited nancial statements

for PART are available through the PART Administrative O ce, 107 Arrow Road, Greensboro, NC 27409.

Jointly Governed Organizations. The Piedmont Triad Regional Council (PTRC) was formed on July 1, 2011 by consolidating the

Northwest Piedmont Council of Governments, and the Piedmont Triad Council of Governments. The PTRC was designated by the

State of NC to serve as the lead regional organization for the Piedmont Triad region. PTRC serves 73 member governments in a 12

county area. Each participating government appoints one member to the council’s governing board. The City paid membership

fees of $50,169 to the council during the scal year ended June 30, 2018.

W I N S T O N S AL E M , N O R T H C AR O L I N A 111