Page 119 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 119

has to be made, the payment will be made by RAMCO from these funds. Traditional insurance contracts cover property damage,

loss of money, and situational risks.

The City carries ood insurance through the National Flood Insurance Plan (NFIP). This insurance provides $1,000,000 per incident

and annual aggregate coverage for Flood Zones pre xed as “B”; $25,000,000 annual aggregate coverage for all other Flood Zones,

except that we do not have coverage for Flood Zones designated as “A” and “V”.

In accordance with G.S. 159-29, the City’s employees that have access to $100 or more at any given time of the City’s funds are

performance bonded through a commercial surety bond. The nance o cer, two assistant nance o cers, investment analyst,

and City revenue collector are individually bonded for $500,000. The remaining employees that have access to funds are bonded

under a blanket bond for $500,000.

Claims payable recorded in the general purpose nancial statements are composed of the self-insurance claims for health bene ts,

workers’ compensation, and retired health insurance, and RAMCO claims for damages.

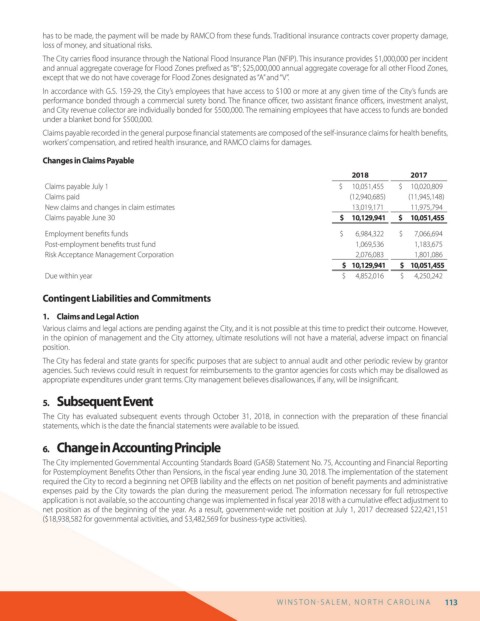

Changes in Claims Payable

2018 2017

Claims payable July 1 $ 10,051,455 $ 10,020,809

Claims paid (12,940,685) (11,945,148)

New claims and changes in claim estimates 13,019,171 11,975,794

Claims payable June 30 $ 10,129,941 $ 10,051,455

Employment bene ts funds $ 6,984,322 $ 7,066,694

Post-employment bene ts trust fund 1,069,536 1,183,675

Risk Acceptance Management Corporation 2,076,083 1,801,086

$ 10,129,941 $ 10,051,455

Due within year $ 4,852,016 $ 4,250,242

Contingent Liabilities and Commitments

1. Claims and Legal Action

Various claims and legal actions are pending against the City, and it is not possible at this time to predict their outcome. However,

in the opinion of management and the City attorney, ultimate resolutions will not have a material, adverse impact on nancial

position.

The City has federal and state grants for speci c purposes that are subject to annual audit and other periodic review by grantor

agencies. Such reviews could result in request for reimbursements to the grantor agencies for costs which may be disallowed as

appropriate expenditures under grant terms. City management believes disallowances, if any, will be insigni cant.

5. Subsequent Event

The City has evaluated subsequent events through October 31, 2018, in connection with the preparation of these nancial

statements, which is the date the nancial statements were available to be issued.

6. Change in Accounting Principle

The City implemented Governmental Accounting Standards Board (GASB) Statement No. 75, Accounting and Financial Reporting

for Postemployment Bene ts Other than Pensions, in the scal year ending June 30, 2018. The implementation of the statement

required the City to record a beginning net OPEB liability and the e ects on net position of bene t payments and administrative

expenses paid by the City towards the plan during the measurement period. The information necessary for full retrospective

application is not available, so the accounting change was implemented in scal year 2018 with a cumulative e ect adjustment to

net position as of the beginning of the year. As a result, government-wide net position at July 1, 2017 decreased $22,421,151

($18,938,582 for governmental activities, and $3,482,569 for business-type activities).

W I N S T O N S AL E M , N O R T H C AR O L I N A 113