Page 114 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 114

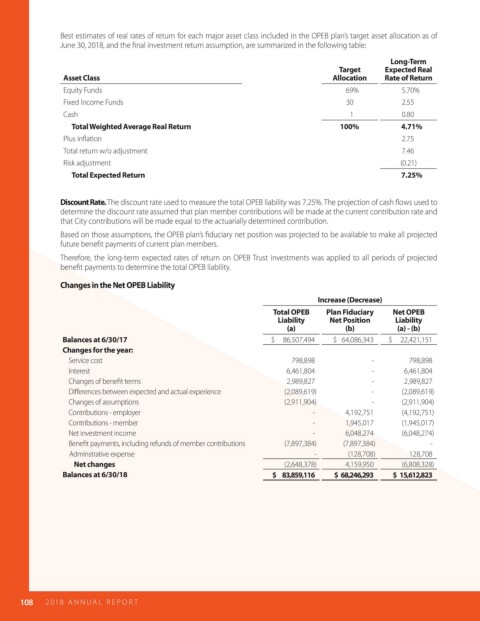

Best estimates of real rates of return for each major asset class included in the OPEB plan’s target asset allocation as of

June 30, 2018, and the nal investment return assumption, are summarized in the following table:

Long-Term

Target Expected Real

Asset Class Allocation Rate of Return

Equity Funds 69% 5.70%

Fixed Income Funds 30 2.55

Cash 1 0.80

Total Weighted Average Real Return 100% 4.71%

Plus in ation 2.75

Total return w/o adjustment 7.46

Risk adjustment (0.21)

Total Expected Return 7.25%

Discount Rate. The discount rate used to measure the total OPEB liability was 7.25%. The projection of cash ows used to

determine the discount rate assumed that plan member contributions will be made at the current contribution rate and

that City contributions will be made equal to the actuarially determined contribution.

Based on those assumptions, the OPEB plan’s duciary net position was projected to be available to make all projected

future bene t payments of current plan members.

Therefore, the long-term expected rates of return on OPEB Trust investments was applied to all periods of projected

bene t payments to determine the total OPEB liability.

Changes in the Net OPEB Liability

Increase (Decrease)

Total OPEB Plan Fiduciary Net OPEB

Liability Net Position Liability

(a) (b) (a) - (b)

Balances at 6/30/17 $ 86,507,494 $ 64,086,343 $ 22,421,151

Changes for the year:

Service cost 798,898 - 798,898

Interest 6,461,804 - 6,461,804

Changes of bene t terms 2,989,827 - 2,989,827

Di erences between expected and actual experience (2,089,619) - (2,089,619)

Changes of assumptions (2,911,904) - (2,911,904)

Contributions - employer - 4,192,751 (4,192,751)

Contributions - member - 1,945,017 (1,945,017)

Net investment income - 6,048,274 (6,048,274)

Bene t payments, including refunds of member contributions (7,897,384) (7,897,384) -

Adminstrative expense - (128,708) 128,708

Net changes (2,648,378) 4,159,950 (6,808,328)

Balances at 6/30/18 $ 83,859,116 $ 68,246,293 $ 15,612,823

108 2018 AN NUAL R E P O R T