Page 61 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 61

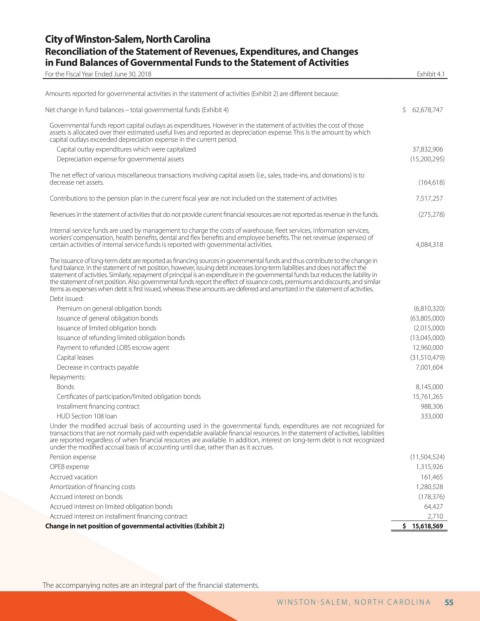

City of Winston-Salem, North Carolina

Reconciliation of the Statement of Revenues, Expenditures, and Changes

in Fund Balances of Governmental Funds to the Statement of Activities

For the Fiscal Year Ended June 30, 2018 Exhibit 4.1

Amounts reported for governmental activities in the statement of activities (Exhibit 2) are di erent because:

Net change in fund balances – total governmental funds (Exhibit 4) $ 62,678,747

Governmental funds report capital outlays as expenditures. However in the statement of activities the cost of those

assets is allocated over their estimated useful lives and reported as depreciation expense. This is the amount by which

capital outlays exceeded depreciation expense in the current period.

Capital outlay expenditures which were capitalized 37,832,906

Depreciation expense for governmental assets (15,200,295)

The net e ect of various miscellaneous transactions involving capital assets (i.e., sales, trade-ins, and donations) is to

decrease net assets. (164,618)

Contributions to the pension plan in the current scal year are not included on the statement of activities 7,517,257

Revenues in the statement of activities that do not provide current nancial resources are not reported as revenue in the funds. (275,278)

Internal service funds are used by management to charge the costs of warehouse, eet services, information services,

workers’ compensation, health bene ts, dental and ex bene ts and employee bene ts. The net revenue (expenses) of

certain activities of internal service funds is reported with governmental activities. 4,084,318

The issuance of long-term debt are reported as nancing sources in governmental funds and thus contribute to the change in

fund balance. In the statement of net position, however, issuing debt increases long-term liabilities and does not a ect the

statement of activities. Similarly, repayment of principal is an expenditure in the governmental funds but reduces the liability in

the statement of net position. Also governmental funds report the e ect of issuance costs, premiums and discounts, and similar

items as expenses when debt is rst issued, whereas these amounts are deferred and amortized in the statement of activities.

Debt issued:

Premium on general obligation bonds (6,810,320)

Issuance of general obligation bonds (63,805,000)

Issuance of limited obligation bonds (2,015,000)

Issuance of refunding limited obligation bonds (13,045,000)

Payment to refunded LOBS escrow agent 12,960,000

Capital leases (31,510,479)

Decrease in contracts payable 7,001,604

Repayments:

Bonds 8,145,000

Certi cates of participation/limited obligation bonds 15,761,265

Installment nancing contract 988,306

HUD Section 108 loan 333,000

Under the modi ed accrual basis of accounting used in the governmental funds, expenditures are not recognized for

transactions that are not normally paid with expendable available nancial resources. In the statement of activities, liabilities

are reported regardless of when nancial resources are available. In addition, interest on long-term debt is not recognized

under the modi ed accrual basis of accounting until due, rather than as it accrues.

Pension expense (11,504,524)

OPEB expense 1,315,926

Accrued vacation 161,465

Amortization of nancing costs 1,280,528

Accrued interest on bonds (178,376)

Accrued interest on limited obligation bonds 64,427

Accrued interest on installment nancing contract 2,710

Change in net position of governmental activities (Exhibit 2) $ 15,618,569

The accompanying notes are an integral part of the nancial statements.

W I N S T O N S AL E M , N O R T H C AR O L I N A 55