Page 71 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 71

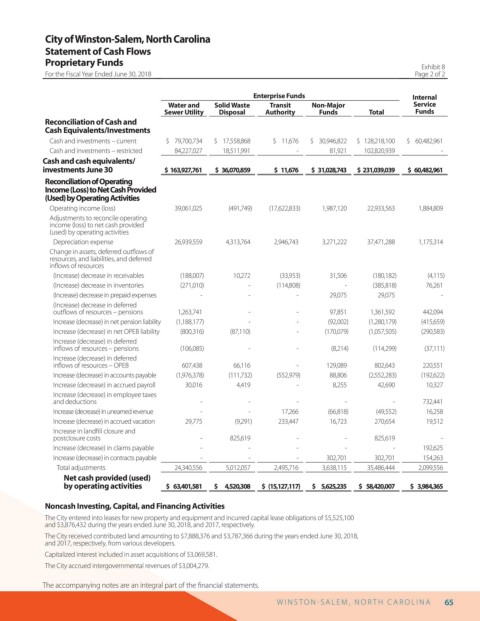

City of Winston-Salem, North Carolina

Statement of Cash Flows

Proprietary Funds Exhibit 8

For the Fiscal Year Ended June 30, 2018 Page 2 of 2

Enterprise Funds Internal

Water and Solid Waste Transit Non-Major Service

Sewer Utility Disposal Authority Funds Total Funds

Reconciliation of Cash and

Cash Equivalents/Investments

Cash and investments – current $ 79,700,734 $ 17,558,868 $ 11,676 $ 30,946,822 $ 128,218,100 $ 60,482,961

Cash and investments – restricted 84,227,027 18,511,991 - 81,921 102,820,939 -

Cash and cash equivalents/

investments June 30 $ 163,927,761 $ 36,070,859 $ 11,676 $ 31,028,743 $ 231,039,039 $ 60,482,961

Reconciliation of Operating

Income (Loss) to Net Cash Provided

(Used) by Operating Activities

Operating income (loss) 39,061,025 (491,749) (17,622,833) 1,987,120 22,933,563 1,884,809

Adjustments to reconcile operating

income (loss) to net cash provided

(used) by operating activities

Depreciation expense 26,939,559 4,313,764 2,946,743 3,271,222 37,471,288 1,175,314

Change in assets, deferred out ows of

resources, and liabilities, and deferred

in ows of resources

(Increase) decrease in receivables (188,007) 10,272 (33,953) 31,506 (180,182) (4,115)

(Increase) decrease in inventories (271,010) - (114,808) - (385,818) 76,261

(Increase) decrease in prepaid expenses - - - 29,075 29,075 -

(Increase) decrease in deferred

out ows of resources – pensions 1,263,741 - - 97,851 1,361,592 442,094

Increase (decrease) in net pension liability (1,188,177) - - (92,002) (1,280,179) (415,659)

Increase (decrease) in net OPEB liability (800,316) (87,110) - (170,079) (1,057,505) (290,583)

Increase (decrease) in deferred

in ows of resources – pensions (106,085) - - (8,214) (114,299) (37,111)

Increase (decrease) in deferred

in ows of resources – OPEB 607,438 66,116 - 129,089 802,643 220,551

Increase (decrease) in accounts payable (1,976,378) (111,732) (552,979) 88,806 (2,552,283) (192,622)

Increase (decrease) in accrued payroll 30,016 4,419 - 8,255 42,690 10,327

Increase (decrease) in employee taxes

and deductions - - - - - 732,441

Increase (decrease) in unearned revenue - - 17,266 (66,818) (49,552) 16,258

Increase (decrease) in accrued vacation 29,775 (9,291) 233,447 16,723 270,654 19,512

Increase in land ll closure and

postclosure costs - 825,619 - - 825,619 -

Increase (decrease) in claims payable - - - - - 192,625

Increase (decrease) in contracts payable - - - 302,701 302,701 154,263

Total adjustments 24,340,556 5,012,057 2,495,716 3,638,115 35,486,444 2,099,556

Net cash provided (used)

by operating activities $ 63,401,581 $ 4,520,308 $ (15,127,117) $ 5,625,235 $ 58,420,007 $ 3,984,365

Noncash Investing, Capital, and Financing Activities

The City entered into leases for new property and equipment and incurred capital lease obligations of $5,525,100

and $3,876,432 during the years ended June 30, 2018, and 2017, respectively.

The City received contributed land amounting to $7,888,376 and $3,787,366 during the years ended June 30, 2018,

and 2017, respectively, from various developers.

Capitalized interest included in asset acquisitions of $3,069,581.

The City accrued intergovernmental revenues of $3,004,279.

The accompanying notes are an integral part of the nancial statements.

W I N S T O N S AL E M , N O R T H C AR O L I N A 65