Page 74 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 74

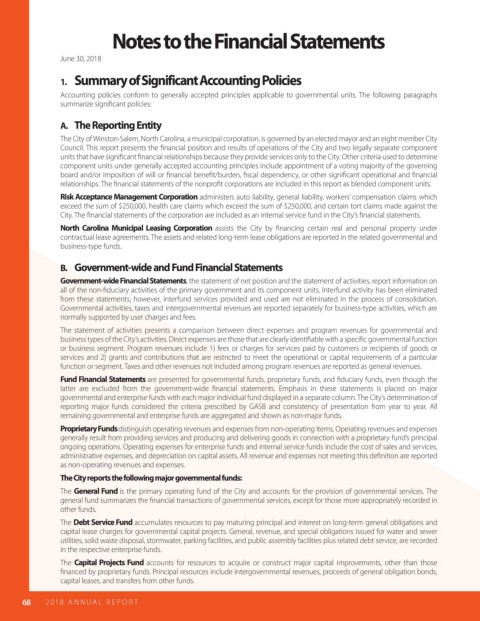

Notes to the Financial Statements

June 30, 2018

1. Summary of Significant Accounting Policies

Accounting policies conform to generally accepted principles applicable to governmental units. The following paragraphs

summarize signi cant policies:

A. The Reporting Entity

The City of Winston-Salem, North Carolina, a municipal corporation, is governed by an elected mayor and an eight member City

Council. This report presents the nancial position and results of operations of the City and two legally separate component

units that have signi cant nancial relationships because they provide services only to the City. Other criteria used to determine

component units under generally accepted accounting principles include appointment of a voting majority of the governing

board and/or imposition of will or nancial bene t/burden, scal dependency, or other signi cant operational and nancial

relationships. The nancial statements of the nonpro t corporations are included in this report as blended component units.

Risk Acceptance Management Corporation administers auto liability, general liability, workers’ compensation claims which

exceed the sum of $250,000, health care claims which exceed the sum of $250,000, and certain tort claims made against the

City. The nancial statements of the corporation are included as an internal service fund in the City’s nancial statements.

North Carolina Municipal Leasing Corporation assists the City by nancing certain real and personal property under

contractual lease agreements. The assets and related long-term lease obligations are reported in the related governmental and

business-type funds.

B. Government-wide and Fund Financial Statements

Government-wide Financial Statements, the statement of net position and the statement of activities, report information on

all of the non- duciary activities of the primary government and its component units. Interfund activity has been eliminated

from these statements; however, interfund services provided and used are not eliminated in the process of consolidation.

Governmental activities, taxes and intergovernmental revenues are reported separately for business-type activities, which are

normally supported by user charges and fees.

The statement of activities presents a comparison between direct expenses and program revenues for governmental and

business types of the City’s activities. Direct expenses are those that are clearly identi able with a speci c governmental function

or business segment. Program revenues include 1) fees or charges for services paid by customers or recipients of goods or

services and 2) grants and contributions that are restricted to meet the operational or capital requirements of a particular

function or segment. Taxes and other revenues not included among program revenues are reported as general revenues.

Fund Financial Statements are presented for governmental funds, proprietary funds, and duciary funds, even though the

latter are excluded from the government-wide nancial statements. Emphasis in these statements is placed on major

governmental and enterprise funds with each major individual fund displayed in a separate column. The City’s determination of

reporting major funds considered the criteria prescribed by GASB and consistency of presentation from year to year. All

remaining governmental and enterprise funds are aggregated and shown as non-major funds.

Proprietary Funds distinguish operating revenues and expenses from non-operating items. Operating revenues and expenses

generally result from providing services and producing and delivering goods in connection with a proprietary fund’s principal

ongoing operations. Operating expenses for enterprise funds and internal service funds include the cost of sales and services,

administrative expenses, and depreciation on capital assets. All revenue and expenses not meeting this de nition are reported

as non-operating revenues and expenses.

The City reports the following major governmental funds:

The General Fund is the primary operating fund of the City and accounts for the provision of governmental services. The

general fund summarizes the nancial transactions of governmental services, except for those more appropriately recorded in

other funds.

The Debt Service Fund accumulates resources to pay maturing principal and interest on long-term general obligations and

capital lease charges for governmental capital projects. General, revenue, and special obligations issued for water and sewer

utilities, solid waste disposal, stormwater, parking facilities, and public assembly facilities plus related debt service, are recorded

in the respective enterprise funds.

The Capital Projects Fund accounts for resources to acquire or construct major capital improvements, other than those

nanced by proprietary funds. Principal resources include intergovernmental revenues, proceeds of general obligation bonds,

capital leases, and transfers from other funds.

68 2018 AN NUAL R E P O R T