Page 77 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 77

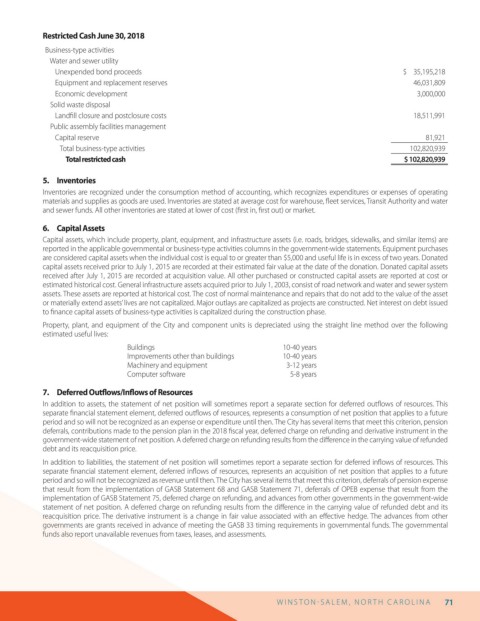

Restricted Cash June 30, 2018

Business-type activities

Water and sewer utility

Unexpended bond proceeds $ 35,195,218

Equipment and replacement reserves 46,031,809

Economic development 3,000,000

Solid waste disposal

Land ll closure and postclosure costs 18,511,991

Public assembly facilities management

Capital reserve 81,921

Total business-type activities 102,820,939

Total restricted cash $ 102,820,939

5. Inventories

Inventories are recognized under the consumption method of accounting, which recognizes expenditures or expenses of operating

materials and supplies as goods are used. Inventories are stated at average cost for warehouse, eet services, Transit Authority and water

and sewer funds. All other inventories are stated at lower of cost ( rst in, rst out) or market.

6. Capital Assets

Capital assets, which include property, plant, equipment, and infrastructure assets (i.e. roads, bridges, sidewalks, and similar items) are

reported in the applicable governmental or business-type activities columns in the government-wide statements. Equipment purchases

are considered capital assets when the individual cost is equal to or greater than $5,000 and useful life is in excess of two years. Donated

capital assets received prior to July 1, 2015 are recorded at their estimated fair value at the date of the donation. Donated capital assets

received after July 1, 2015 are recorded at acquisition value. All other purchased or constructed capital assets are reported at cost or

estimated historical cost. General infrastructure assets acquired prior to July 1, 2003, consist of road network and water and sewer system

assets. These assets are reported at historical cost. The cost of normal maintenance and repairs that do not add to the value of the asset

or materially extend assets’ lives are not capitalized. Major outlays are capitalized as projects are constructed. Net interest on debt issued

to nance capital assets of business-type activities is capitalized during the construction phase.

Property, plant, and equipment of the City and component units is depreciated using the straight line method over the following

estimated useful lives:

Buildings 10-40 years

Improvements other than buildings 10-40 years

Machinery and equipment 3-12 years

Computer software 5-8 years

7. Deferred Out ows/In ows of Resources

In addition to assets, the statement of net position will sometimes report a separate section for deferred out ows of resources. This

separate nancial statement element, deferred out ows of resources, represents a consumption of net position that applies to a future

period and so will not be recognized as an expense or expenditure until then. The City has several items that meet this criterion, pension

deferrals, contributions made to the pension plan in the 2018 scal year, deferred charge on refunding and derivative instrument in the

government-wide statement of net position. A deferred charge on refunding results from the di erence in the carrying value of refunded

debt and its reacquisition price.

In addition to liabilities, the statement of net position will sometimes report a separate section for deferred in ows of resources. This

separate nancial statement element, deferred in ows of resources, represents an acquisition of net position that applies to a future

period and so will not be recognized as revenue until then. The City has several items that meet this criterion, deferrals of pension expense

that result from the implementation of GASB Statement 68 and GASB Statement 71, deferrals of OPEB expense that result from the

implementation of GASB Statement 75, deferred charge on refunding, and advances from other governments in the government-wide

statement of net position. A deferred charge on refunding results from the di erence in the carrying value of refunded debt and its

reacquisition price. The derivative instrument is a change in fair value associated with an e ective hedge. The advances from other

governments are grants received in advance of meeting the GASB 33 timing requirements in governmental funds. The governmental

funds also report unavailable revenues from taxes, leases, and assessments.

W I N S T O N S AL E M , N O R T H C AR O L I N A 71