Page 35 - 2022_OE Benefits Guide

P. 35

Health FSA & LPFSA Dependent Care FSA

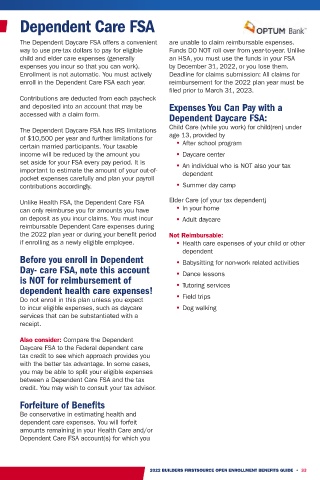

What are they, and should I consider enrolling? The Dependent Daycare FSA offers a convenient are unable to claim reimbursable expenses.

The Company offers two types of accounts that may reimburse you for your eligible out-of-pocket way to use pre-tax dollars to pay for eligible Funds DO NOT roll over from year-to-year. Unlike

expenses; a Health Care Flexible Spending Account (FSA) and a Limited Purpose Flexible Spending child and elder care expenses (generally an HSA, you must use the funds in your FSA

Account (LPFSA). expenses you incur so that you can work). by December 31, 2022, or you lose them.

Enrollment is not automatic. You must actively Deadline for claims submission: All claims for

Enrollment in these accounts is never automatic. It is mandatory that you actively enroll in your FSA enroll in the Dependent Care FSA each year. reimbursement for the 2022 plan year must be

each year during Open Enrollment or your new hire enrollment. filed prior to March 31, 2023.

Contributions are deducted from each paycheck

and deposited into an account that may be Expenses You Can Pay with a

HEALTH FSA LPFSA (LIMITED PURPOSE FSA) accessed with a claim form. Dependent Daycare FSA:

Child Care (while you work) for child(ren) under

The Dependent Daycare FSA has IRS limitations

Standard PPO, Core or Buy-Up HDHP of $10,500 per year and further limitations for age 13, provided by

Which medical plan is this (No HSA). You don’t need to be Core or Buy-Up HDHP with HSA certain married participants. Your taxable • After school program

account available for? enrolled in a medical plan to income will be reduced by the amount you • Daycare center

contribute to a Health FSA. set aside for your FSA every pay period. It is

important to estimate the amount of your out-of- • An individual who is NOT also your tax

dependent

This health care account is only pocket expenses carefully and plan your payroll

Eligible healthcare expenses, contributions accordingly. • Summer day camp

available if you are contributing to

What would I use this account for? including dental, vision and an HSA and you can only use it for

prescription medication expenses. Elder Care (of your tax dependent)

eligible vision and dental expenses. Unlike Health FSA, the Dependent Care FSA

can only reimburse you for amounts you have • In your home

on deposit as you incur claims. You must incur • Adult daycare

What is the maximum amount I $2,750 - the IRS pre-tax reimbursable Dependent Care expenses during

can contribute to this account? contribution limit as of this writing the 2022 plan year or during your benefit period Not Reimbursable:

if enrolling as a newly eligible employee. • Health care expenses of your child or other

Your entire goal amount is dependent

When are the funds available? available at the beginning of the Before you enroll in Dependent

benefit period. • Babysitting for non-work related activities

Day- care FSA, note this account

You will forfeit amounts not is NOT for reimbursement of • Dance lessons

What happens if I don’t use the • Tutoring services

money during the year? claimed for expenses incurred dependent health care expenses!

during the benefit period. • Field trips

Do not enroll in this plan unless you expect

to incur eligible expenses, such as daycare • Dog walking

Contribution allowed for Medicare Yes Yes, to end of year in which services that can be substantiated with a

enrolled? Medicare enrollment first occurs

receipt.

www.optumbank.com Also consider: Compare the Dependent

Provider Contact

1-800-243-5543 Daycare FSA to the Federal dependent care

tax credit to see which approach provides you

with the better tax advantage. In some cases,

How to File FSA Claims you may be able to split your eligible expenses

File claims with OPTUMBank. File claims with OPTUMBank through March 31, 2023 for between a Dependent Care FSA and the tax

credit. You may wish to consult your tax advisor.

2022 FSA expenses incurred through December 31, 2022. Log on to

www.optumbank.com

Forfeiture of Benefits

Be conservative in estimating health and

dependent care expenses. You will forfeit

amounts remaining in your Health Care and/or

Dependent Care FSA account(s) for which you

32 • 2022 BUILDERS FIRSTSOURCE OPEN ENROLLMENT BENEFITS GUIDE 2022 BUILDERS FIRSTSOURCE OPEN ENROLLMENT BENEFITS GUIDE • 33