Page 39 - 2022_OE Benefits Guide

P. 39

Income Protection Long-Term Disability

The Long-Term Disability (LTD) Plan is a fully-insured plan offered through Sun Life. Enrollment in

Basic Short-Term Disability the LTD plan is voluntary. The plan is designed to provide income protection to you during times of

The Company provides Team Members with basic short-term disability (STD) income protection extended illness or injury over several months or even years, depending on your age at the onset

at no cost to you. The STD plan is an employer-funded plan designed to provide 50% base wage of disability. If you are receiving benefit payments under the STD plan, your claim will automatically

transition to Sun Life’s LTD claims unit as you near 180 days of disability. LTD benefits, once

replacement for non-work related injury or illness with an expected duration greater than seven days approved, begin on the 181st day of disability.

to a maximum benefit period of 26 weeks.

Refer to the Disability Plan Comparison chart on p. 36 for a review of both STD and LTD income

Buy-Up Short-Term Disability replacement plan provisions.

Team Members may purchase an added layer of income protection to 66.67% of base wage

replacement by electing the Buy-Up Short-Term Disability plan. Refer to the Disability Plan Cost of LTD Coverage

Comparison chart below for a review of benefits available under the Basic and Buy-Up Short Term The Company shares equally the cost of LTD coverage with you. As of 6/1/2021, the rates have

Disability plans. decreased to $.13/$100 of covered earnings. Your premium cost is determined on your base rate

COMPANY-PAID (BASIC) BUY-UP SHORT-TERM of pay. These premiums are withheld on an after-tax basis. When using Dayforce to review and/or

SHORT-TERM DISABILITY DISABILITY LONG-TERM DISABILITY elect coverage, your cost of coverage is automatically populated. To manually calculate your cost of

Plan Features coverage, you may use this formula to calculate your cost for the LTD coverage:

Plan Pays 50% of base wages 66.67% of base wages 60% of base wages

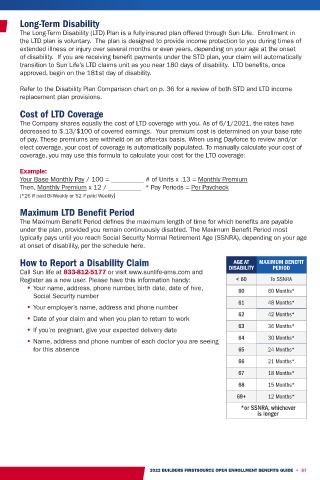

Example:

Plan Benefit Limit $2,000/week $10,000/month Your Base Monthly Pay / 100 = __________ # of Units x .13 = Monthly Premium

Benefit Payment Starts On 8th day of disability On 181st day of disability Then, Monthly Premium x 12 / __________ * Pay Periods = Per Paycheck

(*26 if paid Bi-Weekly or 52 if paid Weekly)

Maximum Benefit Period 26 weeks To Social Security Normal Retirement

Age, depending on age at disability

Who Pays for Coverage Company Paid Employee Paid 50/50 Company/EE Paid Maximum LTD Benefit Period

The Maximum Benefit Period defines the maximum length of time for which benefits are payable

Cost of Coverage $0 $.0235 per $10 $.13 per $100

under the plan, provided you remain continuously disabled. The Maximum Benefit Period most

Proof of Good Health Not required Yes, as a late enrollee* typically pays until you reach Social Security Normal Retirement Age (SSNRA), depending on your age

Pre-Existing Condition Exclusion No Yes, for late enrollees at onset of disability, per the schedule here.

Note: Benefits under short-term disability plans may be reduced by benefits paid under any state short-term disability

programs such as those in California, New Jersey, New York and Washington. How to Report a Disability Claim AGE AT MAXIMUM BENEFIT

Call Sun life at 833-812-5177 or visit www.sunlife-ams.com and DISABILITY PERIOD

TO COMPARE THE AMOUNT OF YOUR STD BENEFIT UNDER BOTH PLANS, FILL IN THE BLANKS BELOW: Register as a new user. Please have this information handy: < 60 To SSNRA

• Your name, address, phone number, birth date, date of hire,

COMPANY-PAID (BASIC) STD PLAN BUY-UP STD PLAN 60 60 Months*

Social Security number

$_____________ $_____________ 61 48 Months*

1. Enter your weekly base pay (If your weekly earnings exceed (If your weekly earnings exceed • Your employer’s name, address and phone number

$4,000, enter $4,000 above) $3,000, enter $3,000 above) • Date of your claim and when you plan to return to work 62 42 Months*

2. Percent of wages replaced by the plan 50% 66.67% 63 36 Months*

• If you’re pregnant, give your expected delivery date

3. Multiply amount on line 1 by the % on • Name, address and phone number of each doctor you are seeing 64 30 Months*

line 2 and enter total here. This is your $______________ $______________

weekly STD benefit amount. for this absence 65 24 Months*

66 21 Months*

Calculate Your Cost for Buy-Up Short-Term Disability

Your premium is determined by your base rate of pay. These premiums are withheld on a pre-tax 67 18 Months*

basis. Shown below is the formula used to populate your premium cost, as reflected when you enroll 68 15 Months*

using Dayforce: 69+ 12 Months*

Example: *or SSNRA, whichever

Your Base Weekly Pay x 66.67%/ 10 = # of units x .0235 = Weekly Premium* is longer

(*Times 2 for Bi-weekly cost)

36 • 2022 BUILDERS FIRSTSOURCE OPEN ENROLLMENT BENEFITS GUIDE 2022 BUILDERS FIRSTSOURCE OPEN ENROLLMENT BENEFITS GUIDE • 37