Page 44 - 2021 Mid Year Open Enrollment Guide

P. 44

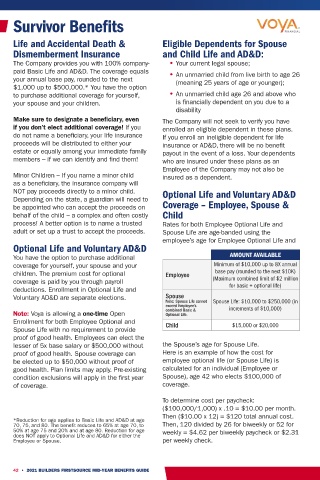

Survivor Benefits CHILD RATE

Age Monthly Rate per $1,000 of Coverage

Life and Accidental Death & Eligible Dependents for Spouse 0-26 .125

Dismemberment Insurance and Child Life and AD&D:

The Company provides you with 100% company- • Your current legal spouse;

paid Basic Life and AD&D. The coverage equals • An unmarried child from live birth to age 26 EMPLOYEE/SPOUSE RATES

your annual base pay, rounded to the next (meaning 25 years of age or younger);

$1,000 up to $500,000.* You have the option AGE AT DISABILITY MAXIMUM BENEFIT PERIOD

to purchase additional coverage for yourself, • An unmarried child age 26 and above who

your spouse and your children. is financially dependent on you due to a Monthly Rate per

disability Age $1,000 of Coverage

Make sure to designate a beneficiary, even The Company will not seek to verify you have

if you don’t elect additional coverage! If you enrolled an eligible dependent in these plans. <25 .05

do not name a beneficiary, your life insurance If you enroll an ineligible dependent for life 25-29 .06

proceeds will be distributed to either your insurance or AD&D, there will be no benefit

estate or equally among your immediate family payout in the event of a loss. Your dependents 30-34 .08

members – if we can identify and find them! who are insured under these plans as an 35-39 .09

Employee of the Company may not also be 40-44 .10

Minor Children – If you name a minor child insured as a dependent.

as a beneficiary, the insurance company will 45-49 .17

NOT pay proceeds directly to a minor child. Optional Life and Voluntary AD&D 50-54 .25

Depending on the state, a guardian will need to

be appointed who can accept the proceeds on Coverage – Employee, Spouse & 55-59 .43

behalf of the child – a complex and often costly Child 60-64 .70

process! A better option is to name a trusted Rates for both Employee Optional Life and

adult or set up a trust to accept the proceeds. Spouse Life are age-banded using the 65-69 1.28

employee’s age for Employee Optional Life and 70-74 2.07

Optional Life and Voluntary AD&D

You have the option to purchase additional AMOUNT AVAILABLE 75+ 4.32

coverage for yourself, your spouse and your Minimum of $10,000 up to 8X annual

children. The premium cost for optional Employee base pay (rounded to the next $10K) Voluntary AD&D – Employee, Spouse & Child

coverage is paid by you through payroll (Maximum combined limit of $2 million

deductions. Enrollment in Optional Life and for basic + optional life) The same rate applies to anyone enrolled in these plans: .025 per $1,000 of coverage.

Voluntary AD&D are separate elections. Spouse 1. Enter number of units of coverage _____

Note: Spouse Life cannot Spouse Life: $10,000 to $250,000 (in 2. Enter Rate .025

exceed Employee’s increments of $10,000)

Note: Voya is allowing a one-time Open combined Basic & 3. Multiply Line 1 X Line 2 _____

Optional Life.

Enrollment for both Employee Optional and Child 4. Multiply Line 2 times 12 _____

Spouse Life with no requirement to provide $15,000 or $20,000 5. Divide Line 4 by 26 for bi-weekly or 52 for weekly rate.

proof of good health. Employees can elect the

lesser of 5x base salary or $500,000 without the Spouse’s age for Spouse Life. This is the amount withheld from your paycheck - _____

proof of good health. Spouse coverage can Here is an example of how the cost for

be elected up to $50,000 without proof of employee optional life (or Spouse Life) is

good health. Plan limits may apply. Pre-existing calculated for an individual (Employee or

condition exclusions will apply in the first year Spouse), age 42 who elects $100,000 of

of coverage. coverage.

To determine cost per paycheck:

($100,000/1,000) x .10 = $10.00 per month.

Then ($10.00 x 12) = $120 total annual cost.

*Reduction for age applies to Basic Life and AD&D at age

70, 75, and 80. The benefit reduces to 65% at age 70, to Then, 120 divided by 26 for biweekly or 52 for

50% at age 75 and 20% and at age 80. Reduction for age weekly = $4.62 per biweekly paycheck or $2.31

does NOT apply to Optional Life and AD&D for either the

Employee or Spouse. per weekly check.

42 • 2021 BUILDERS FIRSTSOURCE MID-YEAR BENEFITS GUIDE 2021 BUILDERS FIRSTSOURCE MID-YEAR BENEFITS GUIDE • 43