Page 45 - 2021 Team Member Benefit Guide - English

P. 45

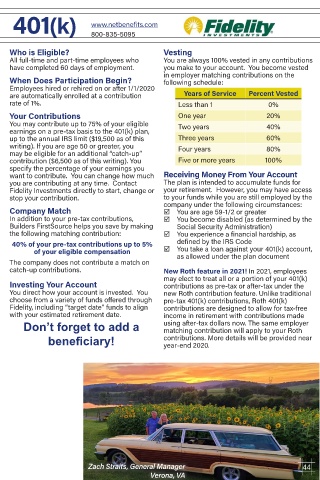

401(k) www.netbenefits.com

800-835-5095

Who is Eligible? Vesting

All full-time and part-time employees who You are always 100% vested in any contributions

have completed 60 days of employment. you make to your account. You become vested

in employer matching contributions on the

When Does Participation Begin? following schedule:

Employees hired or rehired on or after 1/1/2020

are automatically enrolled at a contribution Years of Service Percent Vested

rate of 1%. Less than 1 0%

Your Contributions One year 20%

You may contribute up to 75% of your eligible Two years 40%

earnings on a pre-tax basis to the 401(k) plan,

up to the annual IRS limit ($19,500 as of this Three years 60%

writing). If you are age 50 or greater, you Four years 80%

may be eligible for an additional “catch-up”

contribution ($6,500 as of this writing). You Five or more years 100%

specify the percentage of your earnings you

want to contribute. You can change how much Receiving Money From Your Account

you are contributing at any time. Contact The plan is intended to accumulate funds for

Fidelity Investments directly to start, change or your retirement. However, you may have access

stop your contribution. to your funds while you are still employed by the

company under the following circumstances:

Company Match ; You are age 59-1/2 or greater

In addition to your pre-tax contributions, ; You become disabled (as determined by the

Builders FirstSource helps you save by making Social Security Administration)

the following matching contribution: ; You experience a financial hardship, as

40% of your pre-tax contributions up to 5% defined by the IRS Code

of your eligible compensation ; You take a loan against your 401(k) account,

as allowed under the plan document

The company does not contribute a match on

catch-up contributions. New Roth feature in 2021! In 2021, employees

may elect to treat all or a portion of your 401(k)

Investing Your Account contributions as pre-tax or after-tax under the

You direct how your account is invested. You new Roth contribution feature. Unlike traditional

choose from a variety of funds offered through pre-tax 401(k) contributions, Roth 401(k)

Fidelity, including “target date” funds to align contributions are designed to allow for tax-free

with your estimated retirement date. income in retirement with contributions made

Don’t forget to add a using after-tax dollars now. The same employer

matching contribution will apply to your Roth

beneficiary! contributions. More details will be provided near

year-end 2020.

Zach Straits, General Manager 44 44

Verona, VA