Page 50 - 2021 Team Member Benefit Guide - English

P. 50

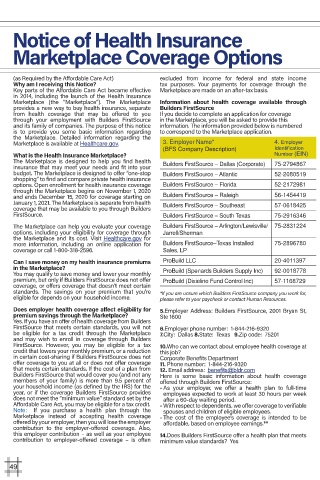

Notice of Health Insurance

Marketplace Coverage Options

(as Required by the Affordable Care Act) excluded from income for federal and state income

Why am I receiving this Notice? tax purposes. Your payments for coverage through the

Key parts of the Affordable Care Act became effective Marketplace are made on an after-tax basis.

in 2014, including the launch of the Health Insurance

Marketplace (the “Marketplace”). The Marketplace Information about health coverage available through

provides a new way to buy health insurance, separate Builders FirstSource

from health coverage that may be offered to you If you decide to complete an application for coverage

through your employment with Builders FirstSource in the Marketplace, you will be asked to provide this

and its family of companies. The purpose of this notice information. The information provided below is numbered

is to provide you some basic information regarding to correspond to the Marketplace application.

the Marketplace. Detailed information regarding the

Marketplace is available at Healthcare.gov. 3. Employer Name* 4. Employer

(BFS Company Description) Identification

What is the Health Insurance Marketplace? Number (EIN)

The Marketplace is designed to help you find health Builders FirstSource – Dallas (Corporate) 75-2794867

insurance that may meet your needs and fit into your

budget. The Marketplace is designed to offer “one-stop Builders FirstSource – Atlantic 52-2080519

shopping” to find and compare private health insurance

options. Open enrollment for health insurance coverage Builders FirstSource – Florida 52-2172981

through the Marketplace begins on November 1, 2020

and ends December 15, 2020 for coverage starting on Builders FirstSource – Raleigh 56-1454419

January 1, 2021. The Marketplace is separate from health Builders FirstSource – Southeast 57-0618425

coverage that may be available to you through Builders

FirstSource. Builders FirstSource – South Texas 75-2916346

The Marketplace can help you evaluate your coverage Builders FirstSource – Arlington/Lewisville/ 75-2831224

options, including your eligibility for coverage through Jarrell/Sherman

the Marketplace and its cost. Visit Healthcare.gov for

more information, including an online application for Builders FirstSource–Texas Installed 75-2896780

coverage or call 1-800-318-2596. Sales, LP

Can I save money on my health insurance premiums ProBuild LLC 20-4011397

in the Marketplace? ProBuild (Spenards Builders Supply Inc) 92-0018778

You may qualify to save money and lower your monthly

premium, but only if Builders FirstSource does not offer ProBuild (Dixieline Fund Control Inc) 57-1168729

coverage, or offers coverage that doesn’t meet certain

standards. The savings on your premium that you’re *If you are unsure which Builders FirstSource company you work for,

eligible for depends on your household income. please refer to your paycheck or contact Human Resources.

Does employer health coverage affect eligibility for 5.Employer Address: Builders FirstSource, 2001 Bryan St,

premium savings through the Marketplace? Ste 1600

Yes. If you have an offer of health coverage from Builders

FirstSource that meets certain standards, you will not 6.Employer phone number: 1-844-216-9320

be eligible for a tax credit through the Marketplace 7.City: Dallas 8.State: Texas 9.Zip code: 75201

and may wish to enroll in coverage through Builders

FirstSource. However, you may be eligible for a tax 10.Who can we contact about employee health coverage at

credit that lowers your monthly premium, or a reduction this job?

in certain cost-sharing if Builders FirstSource does not Corporate Benefits Department

offer coverage to you at all or does not offer coverage 11. Phone number: 1-844-216-9320

that meets certain standards. If the cost of a plan from 12. Email address: benefits@bldr.com

Builders FirstSource that would cover you (and not any Here is some basic information about health coverage

members of your family) is more than 9.5 percent of offered through Builders FirstSource:

your household income (as defined by the IRS) for the • As your employer, we offer a health plan to full-time

year, or if the coverage Builders FirstSource provides employees expected to work at least 30 hours per week

does not meet the “minimum value” standard set by the after a 60-day waiting period.

Affordable Care Act, you may be eligible for a tax credit. • With respect to dependents, we offer coverage to verifiable

Note: If you purchase a health plan through the spouses and children of eligible employees.

Marketplace instead of accepting health coverage • The cost of the employee’s coverage is intended to be

offered by your employer, then you will lose the employer affordable, based on employee earnings.**

contribution to the employer-offered coverage. Also,

this employer contribution – as well as your employee 14.Does Builders FirstSource offer a health plan that meets

contribution to employer-offered coverage – is often minimum value standards? Yes

49